This story is a part of CNN Business’ Nightcap publication. To get it in your inbox, join free, right here.

New York

CNN Business

—

All week, there have occasions within the information which have are available in beneath of the banner of “this hasn’t happened since 2007/2008.”

Yields on the 10-year Treasury briefly surpassed 4%, a degree not seen since 2008. That motion helped push mortgage charges to their highest degree, 6.7%, since — look forward to it — July 2007. Across the pond, the place the UK bond market crashed earlier this week, one seemingly frazzled London banker advised the Financial Times: “At some point this morning I was worried this was the beginning of the end. It was not quite a Lehman moment. But it got close.”

The timing of all these occasions is certainly a bit spooky: Today, September 29, marks 14 years to the day that inventory markets around the globe cratered, ushering within the worst international monetary disaster for the reason that Great Depression.

With all that gloom, it’s pure to wonder if historical past is about to repeat itself.

To be clear: The market ended up recovering utterly — although it took years. And in so some ways, the financial and monetary angst enjoying out around the globe is completely not a repeat of the run-up to the Great Recession. It’s a complete totally different beast now.

But it’s exactly due to these 2008 scars, nonetheless potent reminiscences for a lot of, that economists and analysts grow to be nervous when issues go as haywire as they’ve in latest weeks.

Right now, the prevailing temper is concern. Economies hobbled by inflation and hovering borrowing prices are weak to financial shocks — whether or not these shocks come from a catastrophic hurricane, or a superpower declaring struggle on a neighbor, or a radical unfunded tax scheme. Or, heaven forbid, a resurgent pandemic.

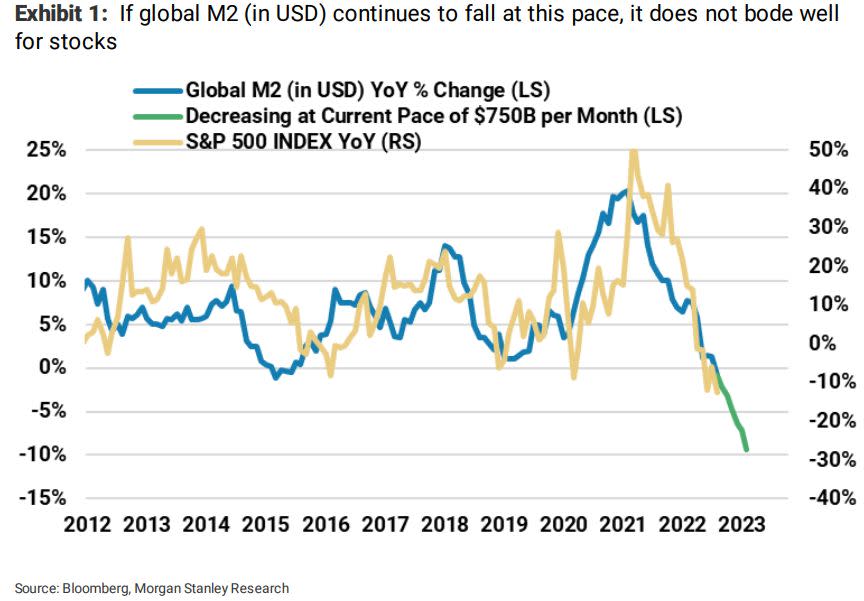

All of meaning there aren’t many good locations for traders to place their cash proper now. Stocks and bonds are each in bear territory, and lots of analysts say the market might stay risky till inflation will get beneath management (which, if we crash right into a recession, might occur fairly quickly… not an awesome silver lining, I do know.)

If there’s a lesson to carry onto from the Great Recession, it’s to not panic. Per my colleague Jeanne Sahadi:

Let’s say you’d invested $10,000 at the beginning of 1981 within the S&P 500. That cash would have grown to just about $1.1 million by the top of March 2021. But had you missed simply the 5 greatest buying and selling days throughout these 40 years, it will solely have grown to roughly $676,000.

In different phrases: Hold on tight, buddies, and attempt to keep away from your 401(okay) steadiness for the foreseeable future.

Stocks fell Thursday, giving up Wednesday’s large positive factors and plunging the Dow again right into a bear market.

The S&P 500, one of many broadest measures of the well being of Corporate America, fell 2.1%, hitting a brand new low for the 12 months. The Dow and S&P 500 are as soon as once more not removed from their lowest ranges since November 2020.

Heckuva approach to wrap up the third quarter, eh? The inventory market truly had a promising begin to the quarter in July. But fears about inflation, fee hikes, rising bond yields and recession returned with a vengeance in August and September.

Continuing a grand custom of Corporate Rebranding Nonsense, Johnson & Johnson is placing all of its shopper well being merchandise beneath a newly fashioned dad or mum firm.

Soon, Band-Aid, Tylenol, Benadryl and Johnson’s child powder will all be offered beneath the umbrella model id “Kenvue.”

That’s pronounced “Ken,” just like the doll, “view.”

Here’s the deal: Johnson & Johnson, the proprietor of those labels, is within the strategy of splitting into two firms — one targeted on medical units and medicines, the opposite on shopper well being merchandise, my colleague Nathaniel Meyersohn stories.

J&J is maintaining its recognizable identify for its bigger pharmaceutical enterprise, but it surely wanted one thing new for the smaller shopper arm.

The firm stated Wednesday that it landed on Kenvue, a mix of “Ken,” an English phrase for information primarily utilized in Scotland, and “vue,” a reference to sight.

“Kenvue” is the profitable moniker {that a} small crew from J&J, working with a naming company, landed on. The objective was to be memorable. And, crucially, to clear logos in additional than 100 markets and “pass linguistic and cultural screenings in 89 languages and dialects.”

The firm additionally launched Kenvue’s new emblem — white letters towards a inexperienced background, the limbs of the letter “K” resembling a sideways coronary heart.

What does it imply? Absolutely nothing, and that’s the level.

Corporations gravitate to names which might be squeaky clear. There’s no chance for a detrimental connotation, as a result of it’s a made-up phrase. It doesn’t, so far as I can inform, sound prefer it would possibly resemble a swear phrase in another language. Kenvue is inoffensive. Bloodless. It is the tofu of company branding.

“It’s really just a holding company behind all these other brands,” one knowledgeable advised Nathaniel. “They want a name that will disappear in the background and the brands will stick out.”

(Mission completed. I’ve already forgotten the brand new identify and I simply typed it 40 seconds in the past.)

MY TWO CENTS

The greatest assessment I can provide of the brand new model is that it’s forgettable. Other firms have famously (infamously?) failed to stay the touchdown with new names.

Netflix, again in 2011, rapidly backtracked after attempting to rechristen its DVD mailing service as “Qwikster.” More not too long ago, Fiat Chrysler and PSA Group merged in 2020 beneath the collective identify “Stellantis,” which continues to be the corporate’s identify, however I nonetheless suppose it feels like one thing you must ask your physician about when you have indicators of seasonal despair.

Enjoying Nightcap? Sign up and also you’ll get all of this, plus another humorous stuff we appreciated on the web, in your inbox each evening. (OK, most nights — we imagine in a four-day work week round right here.)