The U.S. dollar may be losing its appeal as one of the few reliable safe-haven assets in times of economic and geopolitical uncertainty after an 18 month rally, and a further fall by the currency could fuel a 2023 stock-market rally, market analysts said.

But a near-term dollar bounce could pose a test for equity bulls.

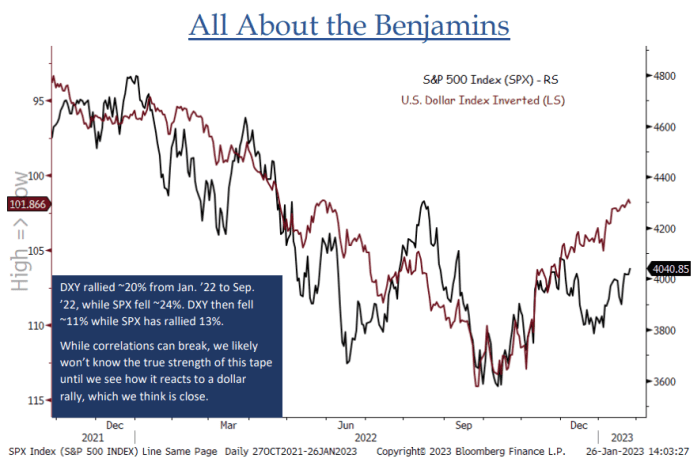

“Over the last 12-14 months there has been a clear inverse correlation between equities and the U.S. dollar…The DXY looks very poised for a countertrend rally here, and we don’t think we can get a true sense of the durability of this rally until we see how stocks react to a rising dollar,” said Jonathan Krinsky, chief market technician of BTIG, in a note last week (see chart below).

SOURCE: BTIG ANALYSIS AND BLOOMBERG

…

2023-02-05 16:22:00 Why the stock market rally may face a big test from the U.S. dollar

Link from www.marketwatch.com

The stock market has been on a rally like never before, and the continuous rise in price has been welcomed by many investors around the world. However, this may soon come to an end, as the US dollar is seen to be creating a testing environment for the stock market.

The US dollar’s appreciation has pushed investors to sell some of their riskier assets, such as stocks, and shift their money into its safe-haven. This has created hesitation among stock investors in purchasing some shares, leading to a decrease in demand for equities.

The stronger dollar has also caused mixed feelings among investors. Although the more robust dollar allows purchase of shares at a cheaper rate, the improving greenback makes overseas investments less attractive. For most investors, they will not be willing to buy stocks with lesser returns.

In the event that the US dollar continues to gain in strength, it may lead to a big test for the stock market rally. Evidence of the rising greenback continues to grow bigger and investors have become more careful in terms of their investments in stocks.

The stock market rally could still remain strong despite the US dollar’s growth if companies continue to deliver impressive performances. As long as there is a continuous growth in revenue and profits, the stock market rally may not be heavily affected.

Nevertheless, the US dollar may still create a challenging environment for the stock market in the near term. Many investors are now cautious when it comes to investing in stocks, and only time will tell whether the stock market rally can withstand the test from the US dollar’s rise.