U.S. shares staged a formidable reversal on Feb. 24 — together with a 950-point intraday transfer to the upside for the Dow Jones Industrial Average

DJIA,

+2.51%

— however there’s an excessive amount of eagerness to declare that the U.S. market has bottomed.

Read: Nasdaq Composite turns a 3.5% loss into 3.3% achieve as inventory market phases epic turnaround after Russia invaded Ukraine. Here are 3 causes for the rebound.

Market bottoms extra usually are made when despondent buyers throw within the towel. Yet the narrative getting used to help the “bottom is in” perception within the Russia-Ukraine battle is that shares spring again rapidly from geopolitical crises. As MarketWatch reported earlier this week: “Despite near-term volatility in the wake of geopolitical events over the past three decades, ranging from terrorist attacks to the start of wars, stocks have tended to bounce back relatively quickly, … rallying 4.6% on average in the six months following such crises dating back to 1990 and rising 81% of the time.”

Or think about this tweet a cash supervisor despatched out after the information broke that Russia had invaded Ukraine: “Excellent buying opportunities never feel good at the time.” After presenting one of many many lists of previous geopolitical occasions which can be circulating round Wall Street, the tweet continued: “Lesson? Buy when there’s blood in the streets.”

“ Like telling a boxer to celebrate being knocked down because it creates the opportunity to get up again. ”

These narratives gloss over the extent of the short-term losses that geopolitical occasions inflict on buyers. The angle adopted by the market’s cheerleaders is like telling a boxer to have fun being knocked down as a result of it creates the chance to rise up once more.

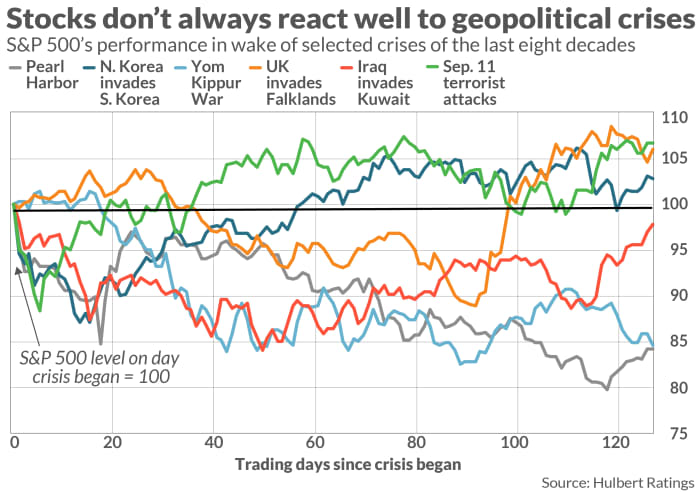

Another drawback with these rosy footage is that they subjectively use previous geopolitical crises to show their level. A far totally different conclusion emerges if we deal with a selected subset of world crises relative to this newest one: warfare.

The chart beneath highlights six main geopolitical occasions since 1941 that concerned navy invasions and/or threats to nationwide sovereignty. The chart plots the S&P 500’s

SPX,

+2.24%

efficiency over the six months following the conclusion of these crises. In three of those six situations, U.S. shares had but to recuperate.

Notice too that it could take weeks or months following a disaster earlier than the market hits backside. The common throughout all six of the crises within the chart is 60 buying and selling days — about three months. In no previous disaster did the market backside on the day of the invasion or assault.

Analysts are usually not mistaken to level out that the market usually registers a backside a number of weeks after a geopolitical disaster. But it’s a matter of emphasis. It’s one factor to remind buyers of this historical past after they count on that the worst remains to be forward. It’s fairly one other to take action when buyers imagine that new bull-market highs will come later this yr.

Mark Hulbert is an everyday contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat charge to be audited. He might be reached at mark@hulbertratings.com

More: Russia’s assault on Ukraine: ‘Now is not a time to be buying the dip’ in shares, cautions Wells Fargo strategist

Also learn: This market-timing mannequin says you most likely have an excessive amount of cash in shares