There’s little question, Wall Street didn’t like Fed Chair Jerome Powell’s Jackson Hole speech. The markets tumbled after Powell confused the central financial institution is dedicated to taming inflation and can implement one other 75bp hike if that’s what is required to get the job accomplished.

The markets may need thrown the toys out of the pram, however whereas cognizant of a bearish situation, Goldman Sachs’ chief economist Jan Hatzius just isn’t overly involved, preferring to concentrate on Powell’s much less hawkish commentary.

“We continue to expect the FOMC to slow the pace from here, delivering a 50bp hike in September and 25bp hikes in November and December, for a terminal rate of 3.25-3.5%. However, additional CPI and employment reports will be available by the September meeting, and Powell stressed that the decision will ‘depend on the totality of the incoming data and the evolving outlook,’” the economist defined. “We see the risks to both the near-term pace and our terminal rate forecast as tilted to the upside.”

Upside is actually on the menu for a pair of shares Goldman Sachs is bullish on proper now – the agency’s analyst Kash Rangan has pinpointed two names which he thinks have at the very least 100% development on the menu for the approaching months. We’ve used the TipRanks platform to learn the way different Wall Street specialists suppose the subsequent yr will pan out for these shares.

Splunk (SPLK)

The first Goldman choose we’ll take a look at is Splunk, a giant knowledge analytics firm. Splunk supplies companies with the instruments to get insights from enormous troves of knowledge. The knowledge can be utilized to tell enterprise choices and assist operations run easily. The firm is a identified chief in IT operations and safety, has an put in base of greater than 20,000 clients, and boasts differentiated tech and a powerful observe file of innovation.

All that could be true, however Splunk has not been resistant to the financial downturn, as was evident when the corporate delivered FQ2 earnings (July quarter) lately.

That’s to not say the report itself was a dud. The firm’s income elevated by 32% year-over-year to achieve $798.75 million, whereas beating the analysts’ expectation for $747.7 million. EPS of $0.09 additionally fared much better than the lack of $0.35 per share Wall Street predicted.

Story continues

However, shares took a battering within the post-earnings session on account of the corporate’s disappointing outlook. Annual recurring income (ARR) – a key metric within the software program house – is now anticipated to achieve $3.65 billion this yr, down from the prior forecast of $3.9 billion. Further souring sentiment, the corporate now sees this yr’s cloud annual recurring income hitting $1.8 billion, additionally beneath the earlier outlook of $2 billion.

Investors had been fast to indicate their disappointment, which Goldman’s Kash Rangan believes is “valid.” However, the lowered outlook doesn’t alter the long-term thesis in any approach.

“We are bullish on Splunk’s rapidly scaling cloud business, significant perpetual license and Non-Cloud ARR renewal opportunity, long-term fundamentals and enhanced value proposition exiting COVID. Moreover, Splunk is an attractive asset with a unique and strategic value proposition,” Rangan opined

“We remain positive on the long-term upside as the company successfully navigates the cloud transition under the direction of the new CEO. Furthermore, approaching the Rule of 40 (revenue growth + free cash flow margin) in FY23 could drive the stock into a higher valuation territory,” Rangan added.

These feedback underpin Rangan’s Buy score whereas his $200 value goal makes room for one-year positive factors of a hefty 114%. (To watch Rangan’s observe file, click on right here)

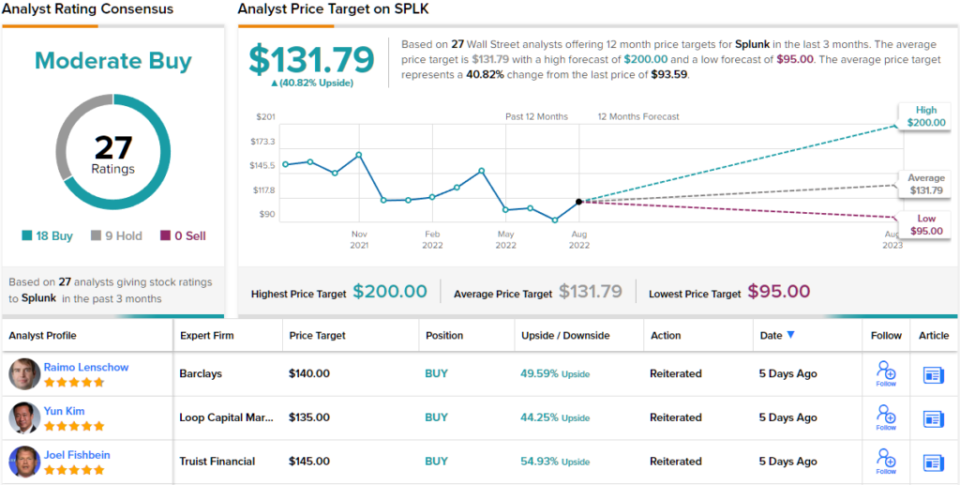

Splunk will get quite a lot of protection on Wall Street; over the previous 3 months there have been 27 analyst critiques, tilting 18 to 9 in favor of Buys over Holds, all leading to a Moderate Buy consensus score. Going by the $131.79 value goal, the shares are anticipated to see ~41% development over the next months. (See Splunk inventory forecast on TipRanks)

Salesforce (CRM)

In the sector of cloud-based buyer relationship administration software program, Salesforce is a market chief, constructing and creating its merchandise for enterprises. Its product portfolio spans throughout gross sales, advertising and marketing, analytics, synthetic intelligence, e-commerce, buyer functions, integration and collaboration. In reality, it virtually covers all aspects of the continuing development of digital transformation. According to the corporate, the TAM (complete addressable market) for its mixed companies by FY26 ought to attain $284 billion.

As has change into de rigueur, Salesforce delivered one other robust set of ends in its lately launched second quarter fiscal 2023 report (July quarter).

Revenue clocked in at $7.72 billion, amounting to a 22% enchancment vs. the identical interval final yr, whereas additionally trumping the consensus estimate of $7.69 billion. The firm beat expectations on the bottom-line too, as adj. EPS of $1.19 got here in forward of the Street’s name for $1.02 per share.

However, regardless of the robust headline metrics, the report did not please buyers; like many others within the present setting, Salesforce has needed to tame expectations for the remainder of the yr. The firm lowered its full-year income forecast to the vary between $30.9 billion and $31 billion. Previously, the corporate has guided for income between $31.7 billion to $31.8 billion.

While shares trended south within the post-earnings session, Goldman’s Rangan thinks the response was unmerited and he sees loads of causes to remain bullish.

“Salesforce remains positioned to capitalize on a number of secular trends driving growth within the company’s large and expanding TAM,” the analyst wrote. “In our view, the company remains broadly positioned to capitalize on digital transformation as companies look to form more holistic views of their customers. We see continued room for improvement in unit economics, as the company’s large installed base and expansive portfolio across multiple product categories position the company to expand share of wallet within customers’ overall IT budgets.”

To this finish, Rangan charges CRM a Buy together with a $320 value goal. What’s in it for buyers? Upside of a sturdy 100%.

Tech shares have a tendency to draw quite a lot of consideration, and Salesforce isn’t any exception – the inventory has 35 analyst critiques on file, and so they embody 30 Buys in opposition to simply 4 Holds and 1 Sell to present the corporate its Strong Buy consensus advice. While the common goal just isn’t fairly as upbeat as Rangan’s, at $227.67, buyers could possibly be sitting on returns of 42% in a yr’s time. (See Salesforce inventory forecast on TipRanks)

To discover good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is essential to do your personal evaluation earlier than making any funding.