New York

CNN

—

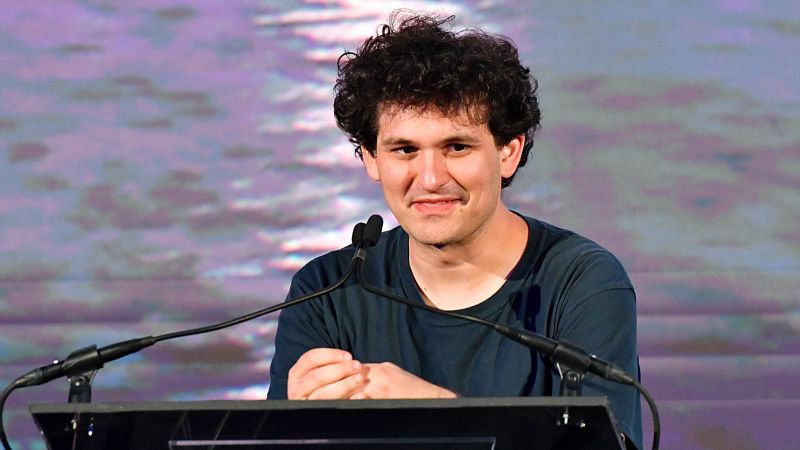

Sam Bankman-Fried, the founding father of the failed crypto change FTX, has agreed to testify earlier than the House Financial Services Committee subsequent week as questions and confusion swirl in regards to the collapse of his firms.

On Friday, he tweeted that he’s “willing to testify on [December] 13th,” and mentioned he’ll “try to be helpful, and to shed what like I can” about a number of of lawmakers’ considerations, together with FTX US’ solvency, “pathways” that would return “value” to customers, what he thinks about what led to the crash, and, lastly, his “own failings.”

“I had thought of myself as a model CEO, who wouldn’t become lazy or disconnected,” Bankman-Fried wrote on Twitter. “Which made it that much more destructive when I did. I’m sorry. Hopefully people can learn from the difference between who I was and who I could have been.”

His tweets are in response to requests from a number of members of Congress who demanded testimony.

Democratic chairman Sen. Sherrod Brown of Ohio and Republican Sen. Pat Toomey of Pennsylvania have requested him to seem as a result of “significant unanswered questions” surrounding the collapse of FTX and its sister hedge fund, Alameda, each of which filed for chapter on November 11.

“You must answer for the failure of both entities that was caused, at least in part, by the clear misuse of client funds and wiped out billions of dollars owed to over a million creditors,” the senators wrote.

Bankman-Fried didn’t say whether or not he would additionally adjust to the Senators’ demand for him testify at a listening to scheduled for Wednesday.

Separately, Sens. Elizabeth Warren of Massachusetts and Tina Smith of Minnesota, each Democrats, despatched letters to a few regulators – the Federal Reserve, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency – asking them to evaluate the normal banking system’s publicity to turmoil within the crypto house, a largely unregulated, parallel monetary system.

“Crypto firms may have closer ties to the banking system than previously understood,” Warren and Smith wrote. “Banks’ relationships with crypto firms raise questions about the safety and soundness of our banking system and highlight potential loopholes that crypto firms may try to exploit to gain further access.”

Federal prosecutors are investigating the collapse of FTX, an change that marketed itself as a beginner-friendly option to become involved in what was, till lately, a booming if extremely unstable marketplace for digital property. FTX additionally facilitated high-risk leveraged buying and selling that wasn’t allowed contained in the United States. (The agency was primarily based in The Bahamas.)

FTX was one of many largest crypto exchanges on the earth till final month, when it confronted a sudden wave of buyer withdrawals that it couldn’t cowl. One of the important thing questions prosecutors are prone to probe is whether or not FTX misappropriated buyer funds when it made loans to Alameda.

Bankman-Fried has denied accusations of misusing buyer deposits. “I didn’t knowingly commingle funds,” he advised The New York Times final week. “I was frankly surprised by how big Alameda’s position was.”

Federal prosecutors are additionally investigating whether or not Bankman-Fried performed a task within the collapse this spring of two interlinked cryptocurrencies, Terra and Luna, in response to the New York Times, which cited two folks acquainted with the matter.

The Times mentioned the problem is a part of a broadening inquiry into the collapse of FTX, and it’s not clear whether or not prosecutors have decided any wrongdoing by Bankman-Fried.

In an announcement to the paper, Bankman-Fried mentioned he was “not aware of any market manipulation and certainly never intended to engage in market manipulation.”

Correction: An earlier model of this story misstated which congressional committee Sam Bankman-Fried mentioned he would testify earlier than. He agreed to testify earlier than the House Financial Services Committee.