From the FTX chapter and downfall of crypto “rock star” Sam Bankman-Fried to the chaos at Twitter, it has not been a very good week for the geniuses of capitalism. Elon Musk’s abrupt and in some instances already reversed selections since taking up the social media firm again up his competition that thus far his tenure “is not boring,” but additionally expose the kind of company governance points which can be too typically repeated to the detriment of shareholders.

“Without a doubt, Sam Bankman-Fried is a genius,” mentioned Yale School of Management management guru Jeffrey Sonnenfeld in an interview with CNBC’s “Taking Stock” on Thursday. “But what’s laborious is that any individual has to have the ability to placed on the brakes on them and ask them questions. But after they develop certainly one of these emperor-for-life fashions … then you definately actually haven’t got accountability,” Sonnenfeld mentioned.

Few would doubt the genius of Elon Musk, or Mark Zuckerberg, for that matter, however few would put them in the identical class with many corporations which have failed spectacularly, although Sonnenfeld says they share the hyperlink of being allowed to function with out sufficient company oversight.

“It’s not loopy to speak about Theranos, or WeWork, Groupon, MySpace, WebMD, or Naptster – so many corporations that fall off the cliff as a result of they did not have correct governance, they did not work out, how do you get the perfect of a genius?” Sonnenfeld mentioned.

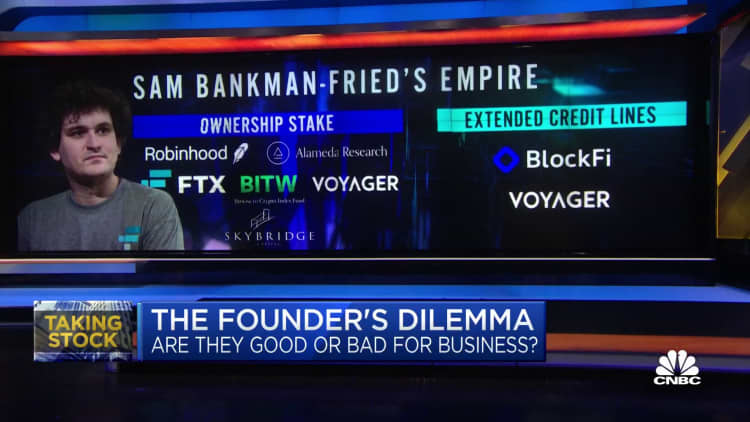

In the case of Bankman-Fried, who stepped down from his CEO position at FTX as the corporate filed for Chapter 11 chapter on Friday, Sonnenfeld pointed to the shortage of a board that ought to have been asking robust questions.

Tom Williams | CQ-Roll Call, Inc. | Getty Images

But boards are sometimes unable to handle genius, Sonnenfeld mentioned. Zuckerberg is one other instance. When Meta, previously Facebook, introduced it will be shifting its focus to the metaverse final yr, Sonnenfeld mentioned his board members had been primarily powerless. Meta laid off 11,000 of its workers this week and introduced a hiring freeze because it has confronted declining income and elevated spending on a metaverse wager that Zuckerberg has mentioned might not repay for a decade.

Tesla shares haven’t been immune from Musk’s Twitter takeover, with the inventory plummeting this week after Musk instructed Twitter workers on Thursday he offered Tesla inventory to “save” the social community. One Wall Street analyst determined that Twitter is now a enterprise danger to Tesla and yanked the inventory from a finest picks record.

Musk (although not Tesla’s founder) and Zuckerberg oversaw the creation of two trillion-dollar corporations, although each have now misplaced that market-cap standing in inventory declines attributable to a wide range of components — from macroeconomic situations to sector-specific dangers, a market valuation reset for top progress corporations, and likewise management selections.

Market analysis reveals that founders could be a monetary danger to firm worth over time. Founder-led corporations have been discovered to outperform these with non-founder leaders in early yr, in accordance with a research from the Harvard Business Review that examined the monetary efficiency of greater than 2,000 public companies, however nearly no distinction seems three years after the corporate’s IPO. After this time, the research discovered that founder-CEOs “truly begin detracting from agency worth.”

Major gamers in Elon Musk’s Twitter deal, together with Fidelity Investments, Brookfield Asset Management and former Twitter CEO and co-founder Jack Dorsey, didn’t sit on the corporate’s board or have a voice all through the transaction, Sonnenfeld mentioned, which gave the deal no oversight. Musk is now splitting his time between six separate corporations: Tesla, SpaceX, SolarCity/Tesla Energy, Twitter, Neuralink and The Boring Company.

Companies led by lone geniuses want robust governance before everything. Sonnenfeld says having built-in checks and balances and a board that has discipline experience in addition to the power to be careful for mission creep is important to permitting these companies to operate with much less danger of pricey blunders.

Tesla and Meta governance scores inside ESG rankings have lengthy mirrored this danger.

That doesn’t suggest the market would not want geniuses.

“Sure, we’re higher off with Elon Musk on this world as we’re higher off with Mark Zuckerberg,” Sonnenfeld mentioned. “But they cannot be alone.”

Through the current points, these under-fire leaders have been important of themselves.

FTX’s Sam Bankman-Fried tweeted Thursday morning that he’s “sorry,” admitting that he “f—ed up” and “ought to have finished higher.”

Zuckerberg mentioned of the mass layoffs at Meta in a press release equal elements apology and unintended restatement of the governance downside, “I take full accountability for this choice. I’m the founder and CEO, I’m accountable for the well being of our firm, for our route, and for deciding how we execute that, together with issues like this, and this was in the end my name.”

Musk tweeted, “Please word that Twitter will do a number of dumb issues in coming months.”

But whether or not an apology or an admission from genius that it too may be dumb every so often, Sonnenfeld says these leaders can be higher off letting others do the criticizing — a lot sooner, and far more typically.

“They should be managed, they should be guided they usually should have a board that may assist get the perfect out of themselves and never allow them to develop this imperial sense of invincibility,” he mentioned.