(Bloomberg) — Signs are piling up that the tech downturn could also be deeper and longer-lasting than feared.

Most Read from Bloomberg

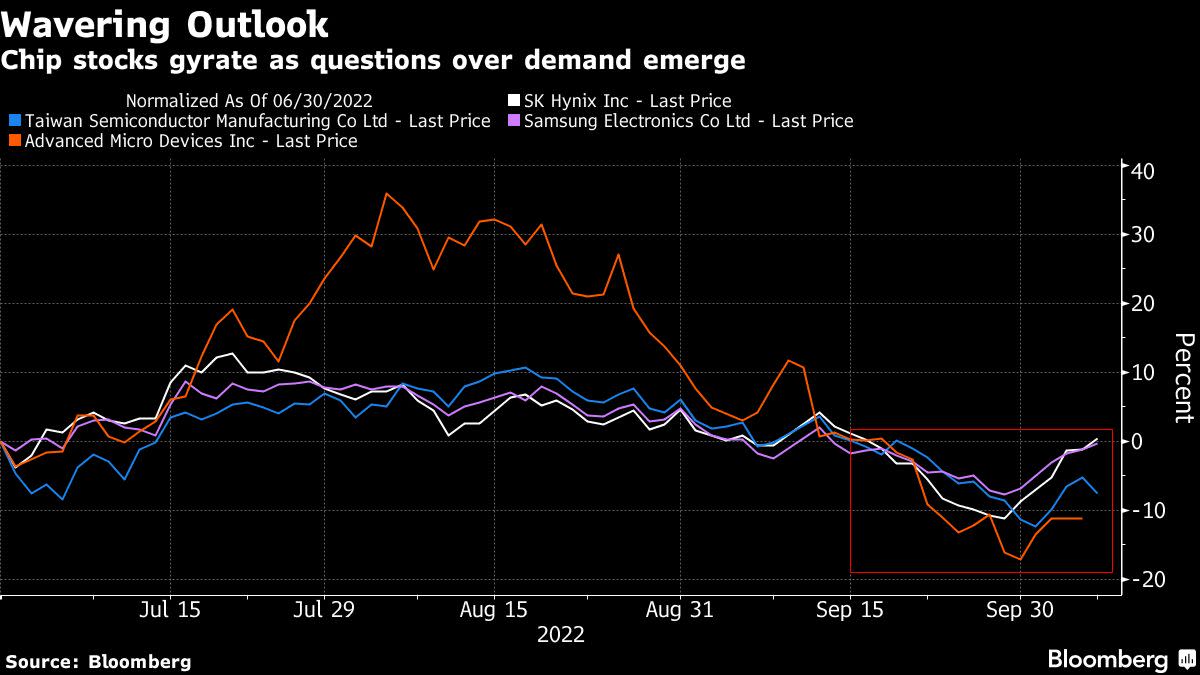

After years of report capital spending, chipmakers are warning on a weekly foundation that demand is sputtering. In the newest signal of bother, Samsung Electronics Co. and Advanced Micro Devices Inc. reported disappointing outcomes inside hours of one another that broadly missed projections.

Samsung — the world’s largest reminiscence chipmaker — reported a 32% dive in working revenue, whereas PC-processor maker AMD stated it should miss its earlier forecast by about $1 billion. Analysts’ reactions ranged from “breathtaking” to “Uff-da!”

Those numbers adopted grim feedback from reminiscence makers Micron Technologies Inc. and Kioxia Holdings Corp., that are slashing spending and output in a bid to stabilize plummeting costs. AMD shares fell, spurring losses in chip gear suppliers from Tokyo Electron Ltd. to shopper PC makers together with Lenovo Group Ltd. on Friday. Disco Corp., whose gear grinds, polishes and dices chips, tumbled 7.1% — dropping essentially the most floor in virtually 16 months.

“It seems end demand has likely deteriorated markedly in recent weeks, and end customers appear to be aggressively draining inventory,” Bernstein’s Stacy Rasgon stated. The reduce in AMD’s client-revenue “is admittedly a bit breathtaking.”

Read: ‘Hard Times’ as Big Memory Makers Cut Output on Supply Glut

Taiwan Semiconductor Manufacturing Co. posted a roughly 48% surge in quarterly income to about NT$613 billion ($19.4 billion) — on the high vary of its steerage in US greenback phrases — helped by its rising clout because the world’s most superior maker of chips. The downtrend in demand could not have been absolutely mirrored within the numbers, particularly given the sharp depreciation of the Taiwan greenback, Haitong International Securities analyst Jeff Pu stated.

Story continues

Weaker-than-expected demand for client electronics is hitting corporations together with surging transport and supplies prices. Cost-cutting has grow to be the brand new norm throughout the tech business, and companies that hoarded chips in the course of the pandemic are actually opting to cancel or postpone orders and faucet stock.

The semiconductor business can also be grappling with export restrictions from the US authorities, which is ratcheting up strain on its allies to stop cargo of cutting-edge chips to a rising checklist of Chinese corporations, because it seeks to include the Asian nation. That’s hampering enterprise for chipmakers from AMD to Nvidia Corp. on the planet’s greatest semiconductor market.

Supply and demand are usually not all that’s behind the present downcycle, stated Heo Pil-Seok, chief govt officer at Midas International Asset Management in Seoul. “The US government’s exports controls would further limit IT companies’ sales in China and a large chunk of demand for chips will be weakened. If AMD, Nvidia can’t sell their chips in China, memory makers’ earnings will deteriorate further.”

The PC section, which has for years been dropping floor to smartphones, appears to be like significantly susceptible. But a critical recession would hammer demand even in areas which have remained strong, comparable to in cloud computing, automotives and manufacturing unit automation.

“We would continue to stay away from PC-centric names, which within our coverage list include AMD, Intel, and Nvidia, due to a likely prolonged PC downturn into next year and continued weakness in consumer gaming,” Baird analysts Tristan Gerra and Tyler Bomba wrote in a be aware to shoppers.

Share costs dropped all through the semiconductor provide chain, from supplies makers like JSR Corp. to chip gear makers comparable to Advantest Corp. and Screen Holdings Co. Even silicon wafer makers comparable to Shin-Etsu Chemical Co. and Sumco Corp. fell.

Read extra: Asia Chip Shares Fall as AMD Sales Miss Estimates by $1 Billion

The corporations themselves are bracing for a chronic downturn. Samsung’s chip enterprise head, Kyung Kyehyun, stated final month he doesn’t see the reminiscence market rebounding all through subsequent 12 months. Kyung informed staff at an inside occasion that Samsung reduce its steerage for chip gross sales within the second half of this 12 months by 32% in comparison with a forecast in April, in accordance with the Korea Economic Daily.

What Bloomberg Intelligence Says

PC demand will proceed to be comfortable in 4Q, given heavy PC processor stock as introduced by chipmaker AMD. Won depreciation won’t be sufficient to offset weak gross sales of reminiscence chips and client electronics, comparable to TVs.

— Masahiro Wakasugi, BI analyst

Click right here for the total analysis

“No party lasts forever,” Rasgon stated. “It’s a cyclical industry. There were a few years of very, very strong growth” that prompted corporations to ramp up capability. “You build supply for demand that turns out not to be as real as you thought it was.”

(Updates with TSMC preliminary outcomes and share reactions from the fourth paragraph)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.