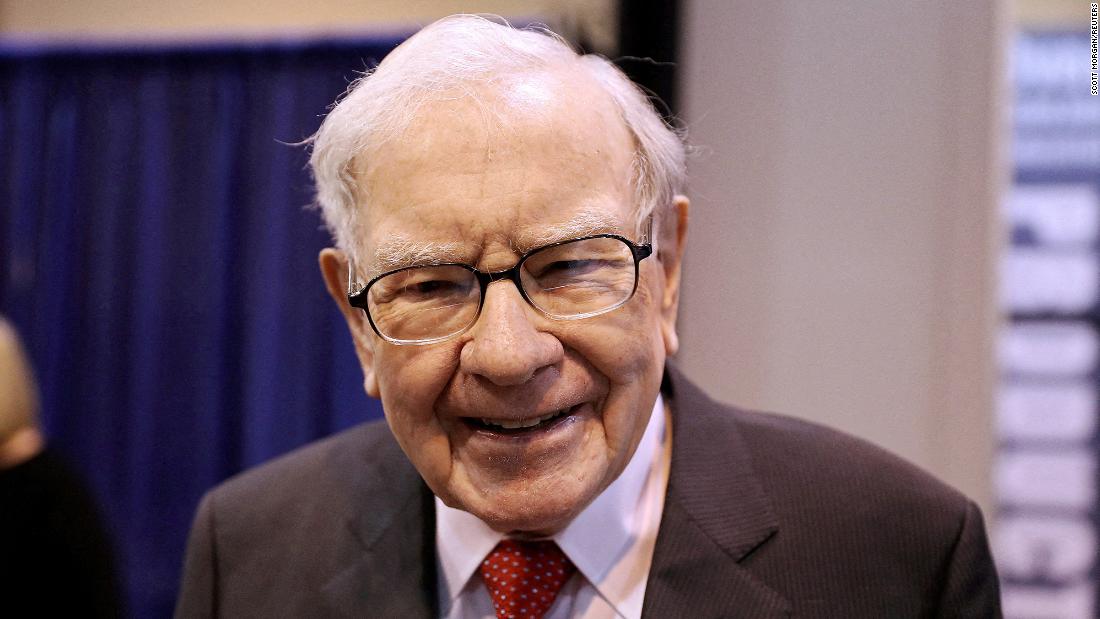

Buffett merely mentioned that the Berkshire Hathaway (BRKB) technique is all about making rational selections and investing for the lengthy haul. “It’s not as a result of we’re good. It’s as a result of we’re sane,” Buffett mentioned in the course of the assembly of Berkshire (BRKA) traders.

Buffett dismissed compliments from one questioner about how he instances the inventory market so nicely. Buffett mentioned that he by no means actually is aware of what shares or the economic system will do within the short-term.

He additionally joked that his bullish bets in the marketplace typically look unhealthy at first, saying that he spent an enormous portion of his internet value in 2008 in the course of the Great Recession shopping for shares at “a horrible time … a extremely dumb time.” Berkshire made investments in Goldman Sachs (GS) and General Electric (GE), amongst different blue chips, earlier than the market lastly bottomed in March 2009.

“We have by no means timed something,” Buffett mentioned, including that the success of the corporate’s long-term “purchase and maintain” funding technique is “easy.”

Both Buffett and Berkshire vice chairman Charlie Munger lamented how speculators have seemingly taken over Wall Street. Munger described the casino-like ambiance and Buffett known as the market a “playing parlor.”

Worries about inflation however reward for Powell

Buffett did not discuss at nice size in the course of the assembly about this 12 months’s market volatility. But he did say that inflation is an enormous drawback, one which “swindles nearly everyone.”

And he gave massive plaudits to Federal Reserve chairman Jerome Powell for his actions to battle the financial disaster brought on by Covid-19, despite the fact that some argue that the Fed’s low charges have helped gas inflation pressures.

Buffett mentioned Powell was a “hero” for being aggressive and shortly slashing charges initially of the pandemic as a substitute of sitting by and “thumb sucking.”

Buffett additionally hinted that Berkshire might reap the benefits of sell-offs, saying that the agency “relies upon” upon market habits creating mispriced alternatives for the corporate.

Along these traces, Berkshire has made some aggressive strikes of late. The firm introduced an $11.6 billion buy of insurance coverage firm Alleghany (Y) in March and likewise has not too long ago disclosed massive stakes in oil agency Occidental Petroleum (OXY) and tech large HP (HPQ).Berkshire mentioned in its earnings launch Saturday that it has elevated its stake in Chevron (CVX). The oil large is now Berkshire’s fourth largest inventory holding, trailing solely Apple (AAPL), Bank of America (BAC) and American Express (AXP).Buffett additionally disclosed in the course of the annual assembly that Berkshire Hathaway has boosted its stake in online game maker Activision Blizzard (ATVI). Berkshire first invested in Activision in late 2021, earlier than Microsoft (MSFT) introduced plans in January to purchase the corporate for practically $70 billion.

Activision’s inventory value is beneath the proposed takeover value. Buffett mentioned that he made the choice to purchase extra of the inventory as an “arbitrage” wager that the deal will finally get performed.

These strikes come only a few weeks after Buffett wrote in his annual shareholder letter that he was having issue discovering shares to purchase at enticing costs. But following the Berkshire shopping for binge, its money readily available has fallen from about $147 billion on the finish of 2021 to round $106 billion on the finish of the primary quarter.

Why the change of coronary heart? Munger, in his usually blunt vogue, mentioned that he and Buffett “discovered some issues we most well-liked proudly owning to Treasury payments.”