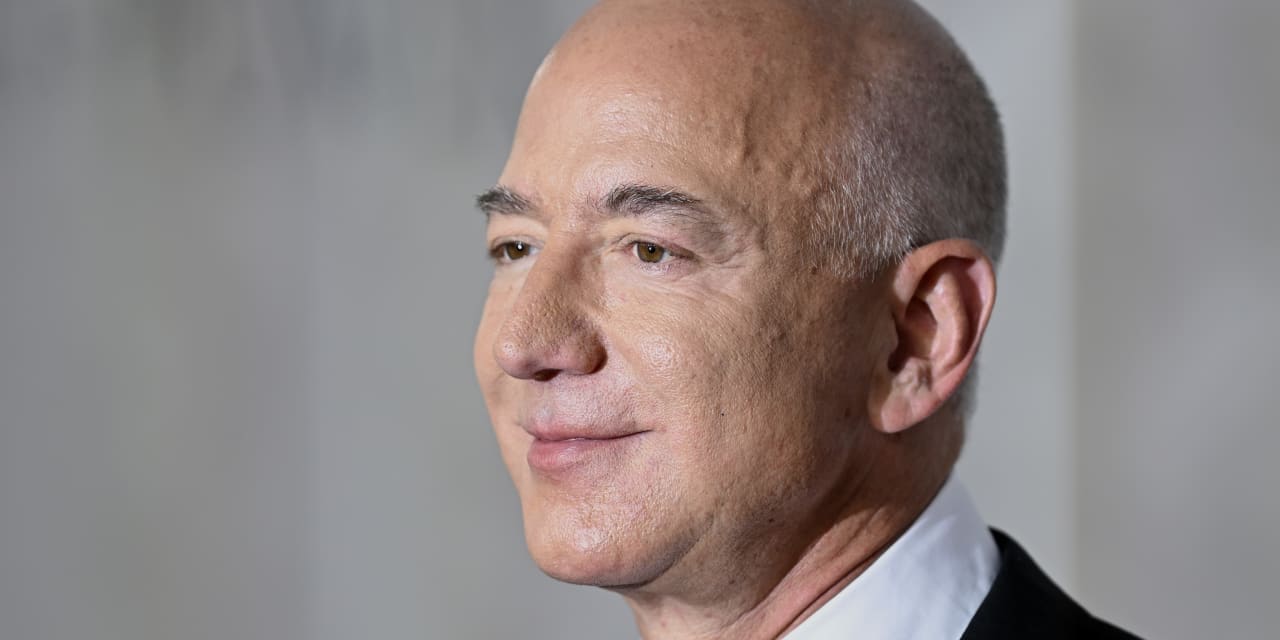

Billionaire Jeff Bezos, who based the e-tail behemoth Amazon, has some spending suggestions as Americans gear up for the vacation purchasing season — amid four-decade-high inflation and recession worries.

Here’s what he mentioned:

“‘If you’re an individual and you’re thinking about buying a large-screen TV, maybe slow that down, keep that cash, see what happens. Same thing with a refrigerator, a new car, whatever. Just take some risk off the table.’”

Bezos made the feedback in a CNN

WBD,

+0.46%

interview that aired this week, the identical interview through which he pledged to offer away most of his fortune in his lifetime.

Why did Bezos supply the tip for shoppers and small enterprise to go simple on big-ticket gadgets? He supplied one large cause.

“If we’re not in a recession right now, we’re likely to be in one very soon,” he mentioned within the interview, choosing up on a cautionary tweet final month that “the probabilities in this economy tell you to batten down the hatches.”

Bezos is at the moment govt chair at Amazon

AMZN,

-2.34%,

transitioning to the function final 12 months as Andy Jassy took up the CEO reins.

Amazon went on to substantiate it was shedding a few of its employees in its system and companies enterprise — becoming a member of a rising listing of tech corporations, together with Facebook dad or mum Meta

META,

-1.57%

— in eliminating massive numbers of jobs. Amazon’s job cuts might quantity round 10,000, in keeping with the Wall Street Journal.

“Critics have taken aim at these words of thrift coming from a man who built Amazon into the 800-pound gorilla of U.S. online shopping and is personally worth some $120 billion.”

To ensure, Bezos is just not alone is his worries a couple of potential recession because the Federal Reserve and different central banks combat greater prices by mountaineering rates of interest.

But his recommendation prompted some guffaws on social media. In a nutshell, critics say these phrases of thrift are a bit wealthy coming from a person — Bezos is now price roughly $120 billion — who constructed Amazon into a web based megabazaar the place shoppers are inspired to seamlessly spend cash.

As Joshua Becker, a proponent of minimalism, wrote on Twitter: “I didn’t hear him mention refraining from Amazon’s Prime Day deals or Black Friday offers, but I recommend adding those items to your list as well.”

Regardless of how one feels about receiving spending recommendation, together with from one of many world’s wealthiest folks, there are worthwhile concerns as vacation purchasing promotions ramp up.

For one factor, possibly there are discretionary bills the place folks can in the reduction of. Many Americans are nonetheless spending briskly, as Walmart

WMT,

-0.34%

third-quarter earnings and October’s retail-sales numbers lately affirmed. Holiday spending projections paint the identical image.

Americans will spend between $942.6 billion and $960.4 billion this vacation season, in keeping with projections from the National Retail Federation. Holiday gross sales final 12 months totaled $889.3 billion, the commerce affiliation mentioned.

“During the third quarter, Americans’ credit-card balances climbed to $930 billion, the biggest annual increase in more than 20 years, according to the National Retail Federation.”

But Americans are planning for the vacations whilst credit-card balances are rising — probably as a result of bank cards are serving to many individuals hold tempo with rising prices.

During the third quarter, Americans’ credit-card balances climbed to $930 billion, the most important annual improve in additional than 20 years, in keeping with Federal Reserve Bank of New York knowledge.

While balances develop, so do credit-card rates of interest. The annual share fee, or APR, on new credit-card affords averaged 19.14% in mid-November, in keeping with Bankrate.com. That beats the outdated file on APRs for brand new playing cards: 19%, three many years in the past.

The vacation purchasing season is usually when Americans accumulate credit-card debt, paying these money owed within the early a part of the next 12 months and repeating the method on the finish of that 12 months.

This 12 months, the stakes are greater amid danger that credit-card payments might arrive and a recession-induced job loss observe. “It’s not the time to overspend and have a problem with paying your bills later,” Michele Raneri, vice chairman of financial-services analysis and consulting at TransUnion

TRU,

-4.90%,

one of many nation’s three main credit score bureaus, has advised MarketWatch. “We know the economy is sending mixed messages.”