Key Insights:

On Saturday, bitcoin rose by 0.56% to log a sixth every day achieve from eight classes.

Negative chatter over crypto laws and market sentiment in the direction of Fed financial coverage pegged bitcoin again from a extra materials achieve.

Bitcoin (BTC) technical indicators stay bearish, with bitcoin sitting on the 100-day EMA.

On Saturday, bitcoin (BTC) rose by 0.56%. Partially reversing a 2.50% fall from Friday, bitcoin ended the day at $29,845.

A bearish begin noticed bitcoin fall to an early morning low of $29,467 earlier than discovering assist.

Steering away from the day’s Major Support Levels, bitcoin struck a day intraday excessive of $29,954.

Falling in need of the First Major Resistance Level at $30,488, nevertheless, bitcoin slipped again into the purple earlier than a late restoration.

Saturday’s upside got here regardless of the US nonfarm payroll figures on Friday, which supported a extra aggressive Fed rate of interest path trajectory.

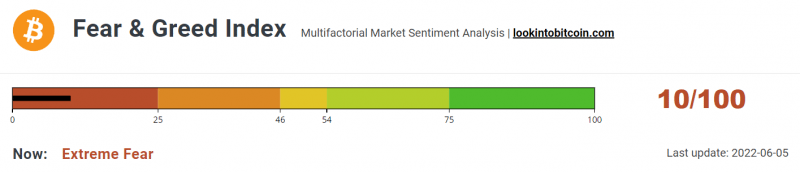

The Bitcoin Fear & Greed Index Sits Deep within the Extreme Fear Zone

Today, the Fear & Greed Index fell from 14/100 to 10/100 regardless of bitcoin’s Saturday achieve and the prospect of ending a nine-week shedding streak.

While falling deeper into the “Extreme Fear” zone, the Index continued to carry above May’s low of 8/100.

Fear & Greed 050622

Regulatory chatter was market damaging, with regulators and lawmakers calling for better oversight.

Going into the weekend, Governor Christopher J. Waller talked about “Risk in the Crypto Markets.”

The governor talked of excessive volatility being the rule and never the exception and the frequent prevalence of fraud and theft.

Waller additionally targeted on retail customers with an absence of crypto expertise and the necessity for some commonplace guidelines.

South Korean lawmakers had been additionally lively going into the weekend. According to native media, regulators plan to maneuver past the Capital Markets Act following the collapse of TerraUSD (UST) and Terra LUNA.

Bitcoin (BTC) Price Action

At the time of writing, BTC was down 0.45% to $29,712.

A spread-bound begin to the day noticed bitcoin rise to an early morning excessive of $29,882 earlier than falling to a low of $29,712.

Story continues

BTCUSD 050622 Daily Chart

Technical Indicators

BTC might want to transfer again via the $29,754 pivot to focus on the First Major Resistance Level at $30,045.

BTC would wish the broader crypto market to assist to interrupt out from Saturday’s excessive of $29,954.

An prolonged rally would check the Second Major Resistance Level at $30,241 and resistance at $30,500. The Third Major Resistance Level sits at $30,728.

Failure to maneuver again via the pivot would check the First Major Support Level at $29,554. Barring one other prolonged sell-off, BTC ought to avoid sub-$29,000 ranges. The Second Major Support Level at $29,267 ought to restrict the draw back.

BTCUSD 050622 Hourly Chart

Looking on the EMAs and the 4-hourly candlestick chart (beneath), it’s a bearish sign. Bitcoin sits beneath the 50-day EMA, at the moment at $30,051. The 50-day pulled again from the 100-day EMA. The 100-day EMA slipped again from the 200-day EMA; BTC damaging.

A transfer via the 100-day EMA, at the moment at $30,260, would assist a run at $31,000.

BTCUSD 050622 4 Hourly Chart

This article was initially posted on FX Empire