Every investor needs to see his shares repay – or he wouldn’t be within the markets. But discovering the correct funding, the ‘one’ that can convey earnings, it doesn’t matter what route the general markets take, can typically be difficult.

The two easiest programs of motion an investor can take to make sure strong returns are based mostly on frequent sense. The first is, to purchase low and promote excessive. That is, discover a low cost inventory with sound fundamentals and good prospects for progress – and purchase in to make the most of the expansion potential. The second frequent sense transfer is to purchase shares that can pay you again. That is, purchase into dividend shares.

Today we’re going to have a look at two shares that supply traders the very best from each of these routes towards market success. According to TipRanks’ database, these are Strong Buys, with a dividend yield as much as 7% and substantial upside potential. And all that for a value of entry under $5.

National CineMedia (NCMI)

The first inventory we’ll take a look at lives in an enchanting area of interest, one that the majority of us virtually definitely by no means take into consideration. National CineMedia is within the promoting enterprise, creating, producing, and distributing advertisements that run earlier than the flicks within the theater begin. The firm advantages from having one thing of a captive viewers, one already cued to observe what’s on the display.

Unsurprisingly, NCMI shares plummeted again in February of 2020, when the corona pandemic compelled closures of the movie show chains. And equally unsurprisingly, the inventory has not regained its pre-corona worth ranges.

In the newest quarter reported, for 3Q21, NCMI confirmed $31.7 million on the high line. While effectively in need of pre-pandemic ranges (which commonly exceeded $100 million), and whereas it missed the Street’s estimates by roughly 25%, it was nonetheless up a whopping 428% year-over-year. Also, it was the second quarter in a row of accelerating revenues, and even after a yr or extra of pandemic-related headwinds, NCMI nonetheless has $64.4 million in money property out there.

Story continues

Those money property are serving to to fund the corporate’s dividend, which it has been cautious to proceed to paying out in the course of the corona disaster. While National CineMedia has been compelled to decrease the cost, it has been in a position to preserve the dividend for the previous two years with out lacking a quarterly cost. The most up-to-date dividend, paid in December, was set at 5 cents per frequent share, or 20 cents annualized, which provides a yield of seven.3%. This compares favorably to the typical yield discovered amongst peer shares, which is at present about 2%.

In protection of this inventory for B. Riley Securities, 5-star analyst Eric Wold writes: “We remain positive on the opportunity for the ‘lights down’ strategy to differentiate NCMI’s offering vs. the emerging AVOD networks—given that NCMI’s platform can offer a larger and more captive audience of key demographics. While we are modeling NCMI’s advertising revenues throughout 2022/2023 to, more or less, mirror box office and attendance patterns, we would expect to see some positive separation in the coming quarters as NCMI benefits from stronger inventory utilization and higher CPMs…”

Wold additionally turns to the corporate’s liquidity state of affairs, including, “Not only did NCMI have enough liquidity to push through year-end and into January (with LLC cash + additional revolver capacity + the Inc. loan), the company will start to benefit from incoming cash flow on the stronger 4Q21 seasonality and monetization of the upfront advertising commitments.”

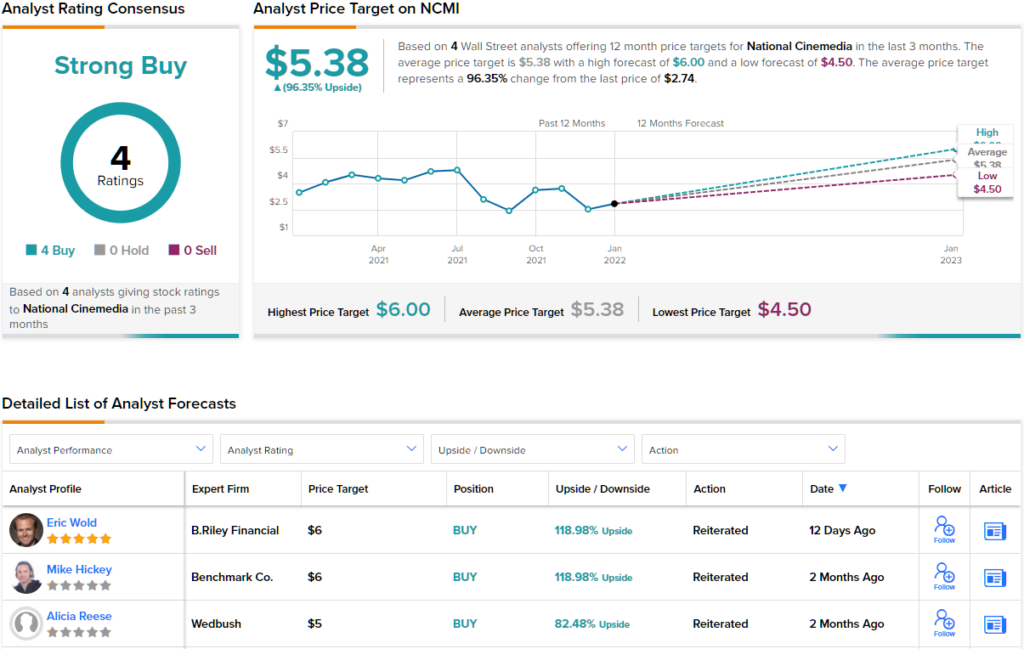

Based on these feedback, Wold provides NCMI inventory a Buy ranking, and his $6 worth goal suggests it has ~119% room to run this yr. (To watch Wold’s observe report, click on right here)

Wall Street appears to share Wold’s view right here, because the inventory has 4 constructive critiques to again its Strong Buy consensus ranking. The shares are priced at $2.74 and have a median worth goal of $5.38, suggesting ~96% good points for 2022. (See NMCI inventory forecast on TipRanks)

loanDepot, Inc. (LDI)

Next up is loanDepot, an originate-to-sell lending platform centered on residential mortgage merchandise, with a multi-channel go-to-market technique that makes use of each a direct branded presence in addition to diversified partnerships.

loanDepot is comparatively new to the general public markets, because it solely held its IPO in February of final yr. The firm, nevertheless, has been buffeted by issues since its IPO. First, the corporate operates in a extremely aggressive area of interest, nonbank retail mortgage lending; second, loanDepot has been compelled to face a number of lawsuits in the previous few months, involving allegations of enterprise fraud and worker discrimination. All of this has put heavy headwinds in the best way of the corporate.

The firm has strengths, nevertheless, permitting it to fulfill the challenges. To begin with, the corporate’s most up-to-date fiscal report, for 3Q21, confirmed the ninth quarter in a row of year-over-year market share progress, as its share grew 46% to three.5%. Furthermore, the corporate reported $923.8 million on the high line. While this was down from $1.36 billion within the year-ago quarter, it was up a strong 18% from Q2. EPS did even higher, rising from 7 cents in Q2 to 40 cents in Q3. loanDepot reported having $506 million in money on the finish of Q3, a price that has grown steadily for the reason that finish of December 2020.

The revenues and earnings, and the strong money holding, all mixed to provide the corporate confidence to maintain up the dividend. LDI’s most up-to-date declaration was 8 cents per share, its third in a row at that stage. With an annualized cost of 32 cents per frequent share, the corporate provides a dividend yield of 6.5%.

Kevin Barker, 5-star analyst from Piper Sandler, takes a bullish stand on LDI, writing: “In our view, LDI appears better positioned to weather the current rate cycle, which should allow the company to remain reasonably profitable despite heavy competition. This should lead to downside protection via incremental book value growth while an unexpected turn in the market (i.e. rates move lower) could lead to a significant jump higher in the stock.”

Barker takes this upbeat stance regardless of the pending lawsuits. He doesn’t keep away from that headwind, however he doesn’t see it as decisive presently. Barker writes of the fits, “We can not ignore these allegations and we have no idea if they’ve benefit. However, we consider the potential final result of this lawsuit and a possible regulatory motion would have a restricted affect.”

Overall, LDI will get an Overweight (i.e. Buy) ranking from Barker, and an $8 worth goal that suggests an upside of 63% within the subsequent 12 months. (To watch Barker’s observe report, click on right here)

Wall Street seems to be in broad settlement with Barker, as LDI shares preserve a Strong Buy ranking from the analyst consensus. There have been 8 current critiques, together with 6 Buys and a couple of Holds. Meanwhile, the inventory’s $10.19 common worth goal implies ~108% upside potential from the $4.90 buying and selling worth. (See LDI inventory forecast on TipRanks)

To discover good concepts for dividend shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is essential to do your individual evaluation earlier than making any funding.