As the painful first half of 2022 ends, many earnings traders are hoping for some type of reduction. Many dividend shares have seen their yields creep subtly larger in current months as their share costs slowly trended decrease.

For earnings traders, the present atmosphere has been fairly hostile to dip-buyers.

We’ve suffered fairly just a few short-lived bear market bounces this 12 months. Many extra are certain to observe.

Though the chance of a V-shaped restoration is diminishing with each swift transfer decrease, there are nonetheless loads of oversold shares on the market overdue for a reduction bounce.

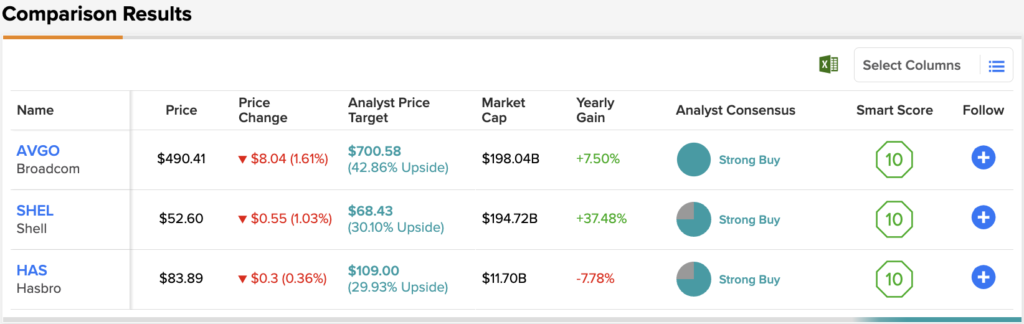

In this piece, we’ll use the TipRanks Comparison Tool to judge three dividend shares that Wall Street nonetheless views as “Strong Buys.”

Broadcom (AVGO)

Broadcom inventory is a designer and developer of semis and related software program. The chip inventory plunge has been brutal to the $195 billion agency, which is now off 27% year-to-date.

The firm not too long ago agreed to amass virtualization software program firm VMWare, in a deal price $61 billion. Such a deal bolsters Broadcom’s software program presence, and given the timing of the deal (after a large decline in tech shares), there is a good probability that Broadcom walked away with a discount. Add potential synergies into the equation, and the VMWare deal is one which ought to be applauded by traders.

Despite Broadcom’s diversification into software program by way of M&A, the corporate continues to be topic to the ups and downs of the semi area. Though chip demand stays extremely sturdy to this point, there isn’t any telling what a extreme recession might entail for the chip maker.

On the one hand, networking chip demand appears to be on the uptrend, thanks partly to the resilience of the enterprise, who’s nonetheless greater than keen to spend money on the digital transformation pattern. On the opposite hand, it is troublesome to gauge the place demand will likely be at year-end if additional proof of an financial slowdown materializes.

If demand diminishes quickly, any supply-chain ramp-up in response to the semi scarcity might result in discounting down the street. Over many quarters, chip demand has been excessive, however provide is constrained. Once provide is again so as, there isn’t any telling the place demand will likely be. For Broadcom, that is a significant near-term danger.

Story continues

In any case, I’m a fan of Broadcom’s newest acquisition. It demonstrates that administration is disciplined concerning costs they will pay. At writing, AVGO inventory trades at 6.7 occasions gross sales and 24.3 occasions trailing earnings. With a 3.38% dividend yield, Broadcom looks like a terrific worth.

It’s not typically that the analysts all agree on a inventory, so when it does occur, take be aware. AVGO’s Strong Buy consensus score is predicated on a unanimous 13 Buys. The inventory’s $700.58 common value goal suggests a substantial upside of ~47% from the present share value of $477.84. (See AVGO inventory forecast on TipRanks)

Shell (SHEL)

Shell is an oil supermajor that lastly slipped right into a correction after operating with the power bulls for over a 12 months. Shell is a British agency with a simplified share construction, and a juicy 3.5% dividend yield following the newest pullback.

As oil costs creep larger once more, it is robust to rely out the power big because it seems to take advantage of its oil and gasoline windfall. Over the long term, Shell is able to transition into renewables, with an energy-as-a-service mannequin that reacts accordingly to the occasions.

Indeed, renewables are the longer term, and Shell desires to be related in such a future. In the meantime, it is all in regards to the upstream and advertising and marketing segments, that are nonetheless closely influenced by the value of oil. As upstream slowly winds down manufacturing over time, Shell is probably not the go-to play to play a “larger for longer” kind of atmosphere.

In any case, the LNG (liquefied pure gasoline) enterprise is a wonderful transitionary power that may assist Shell slowly scale back its carbon emissions over the many years. With a low 0.7 beta and a modest 9.4 occasions trailing earnings a number of, Shell is a good inventory to hedge your bets.

The 4 current analyst evaluations on this power firm break down 3 to 1 in favor of Buys over Holds, and help the Strong Buy analyst consensus score. Shares are buying and selling for $51.90 and the typical goal of $68.43 implies an upside of ~32%. (See SHEL inventory forecast on TipRanks)

Hasbro (HAS)

Hasbro is a toy firm that is slid about 20% year-to-date. The inventory by no means regained its pre-pandemic highs. Now that we’re speaking a few recession, the inventory has been downtrending once more. While it is unlikely that Hasbro will revisit 2020 lows, it looks like a shopper recession might weigh closely on vacation demand. For such a seasonal inventory, current macro headwinds will not be encouraging.

Still, analysts are upbeat, with a “Strong Buy” score. The inventory is holding its personal reasonably effectively via the current wave of supply-chain disruptions. Just as a result of the provision facet is heading in the right direction doesn’t imply demand will stay sturdy going into year-end. Further, a continuation of COVID headwinds might additionally weigh closely.

Though digital video games and different applied sciences might steer spending away from toys, I do suppose there isn’t any motive why bodily toys and video games cannot co-exist. They have for years, in spite of everything.

For now, the retail stalwart is a low-cost earnings play. At writing, the inventory trades at 1.8 occasions gross sales and 28.2 occasions trailing earnings, with a 3.34% dividend yield.

Overall, HAS inventory has picked up 8 current analyst evaluations, which break down to six Buys in opposition to 2 Holds, for a Strong Buy consensus score. The shares are buying and selling for $81.35, and their $109 common value goal signifies ~34% upside for the following 12 months. (See HAS inventory forecast on TipRanks)

Conclusion

Many analysts have been reducing the bar on value targets and scores on shares of late. The following three names have retained their “Strong Buy” standing and are nice long-term performs for yield hunters.

Wall Street expects essentially the most from Broadcom of the three names on this piece, with greater than 40% in year-ahead upside.

To discover good concepts for dividend shares buying and selling at enticing valuations, go to TipRanks’ Best Stocks to Buy, a newly launched software that unites all of TipRanks’ fairness insights.

Read full Disclosure