Qualcomm Inc. shares rallied within the prolonged session Wednesday after the chip maker’s document quarterly outcomes and robust outlook blew previous Wall Street estimates and the corporate assured analysts that demand continues to outstrip provide.

Qualcomm

QCOM,

+1.20%

stated it expects adjusted earnings of $2.75 to $2.95 a share within the third quarter on income of $10.5 billion to $11.3 billion, whereas analysts surveyed by FactSet estimated $2.64 a share on income of $10.02 billion.

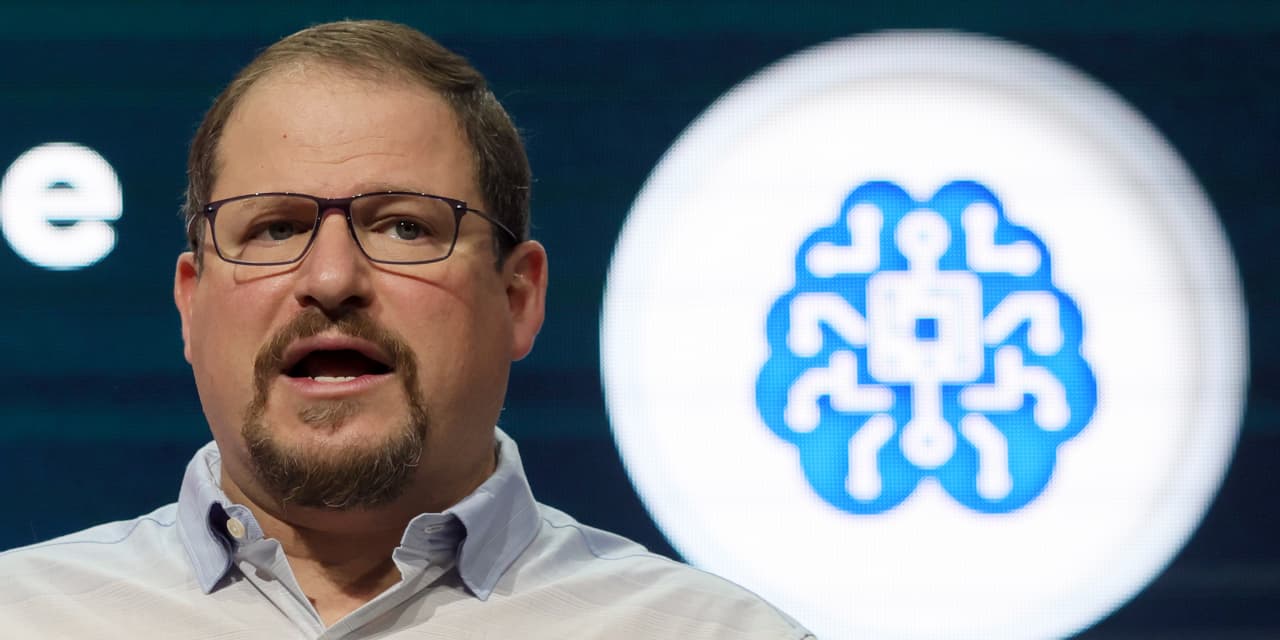

While some analysts are involved that chip inventories are on the rise and that the availability scarcity is starting to return to an in depth, Qualcomm Chief Executive Cristiano Amon dismissed these worries on a convention name, and stated continued sturdy demand is labored into the corporate’s steering.

“We’ll still have more demand than supply across all business,” Amon advised analysts.

An enormous driver of these gross sales come from the corporate’s core handset enterprise, which noticed sturdy features within the second quarter and that Qualcomm Chief Financial Officer Akash Palkhiwala characterised to MarketWatch in an interview as the corporate’s so-called “mature” enterprise.

For instance, handset-chip gross sales soared 56% to $6.34 billion from a yr in the past, whereas the Street anticipated $5.91 billion. Handset gross sales are part of Qualcomm’s CDMA applied sciences, or QCT, section.

“We’re not just gaining share, which we did especially at Samsung where they decided to use our chip rather than their own internal chip for [their Galaxy S22 smartphone],” Palkhiwala advised MarketWatch. “We’re also gaining share in terms of content … chips are becoming more complex and fewer people make those chips, and that plays to our advantage.”

The firm forecast third-quarter QCT gross sales of $9.1 billion to $9.6 billion, and gross sales from Qualcomm’s know-how licensing, or QTL, section of $1.4 billion to $1.6 billion. Analysts had forecast $8.44 billion in QCT gross sales and QTL income of $1.51 billion.

In truth, CEO Amon expects Samsung

005930,

-0.15%

to proceed preferring Qualcomm’s Snapdragon chip over its personal inside chip for its high-end telephones.

“In many of those markets that are now new markets to Qualcomm, Samsung is actively advertising Snapdragon as an ingredient brand for the Galaxy S22,” Amon advised analysts. “I think that’s a very significant data point…I think we’re very confident that Samsung relationship is going to continue to be an extending relationship for us.”

Qualcomm shares rose greater than 6% after hours, following a 1.2% acquire within the common session to shut at $135.10.

Read: Why semiconductor shares are ‘almost uninvestable’ regardless of document earnings amid a world scarcity

The firm reported second-quarter internet earnings of $2.93 billion, or $2.57 a share, in contrast with $1.76 billion, or $1.53 a share, within the year-ago interval. The chip maker reported adjusted earnings, which exclude stock-based compensation bills and different gadgets, of $3.21 a share, in contrast with $1.90 a share within the year-ago interval. Total income for the second quarter rose to a document $11.16 billion from $7.94 billion within the year-ago interval.

Analysts estimated earnings of $2.95 a share, based mostly on Qualcomm’s forecast of $2.80 to $3 a share, and income of $10.63 billion, based mostly on Qualcomm’s income forecast of $10.2 billion to $11 billion.

RF front-end gross sales rose 28% to $1.16 billion in contrast with an anticipated $1.12 billion, auto-chip gross sales grew 41% to $339 million in contrast with the Street’s $282.4 million estimate, and Internet of Things, or IoT, gross sales surged 61% to $1.72 billion versus a $1.61 billion Street view.

Qualcomm reported QCT income of $9.55 billion, a 52% acquire from a yr in the past. Analysts had estimated $8.9 billion, based mostly on the corporate’s forecast of $8.7 billion to $9.3 billion. QCT consists of handset and RF chips in addition to chips for autos and IoT.

Revenue from the QTL section slipped 2% to $1.58 billion for the primary quarter, however have been nonetheless above Wall Street estimates of $1.55 billion, based mostly on an organization forecast of $1.45 billion to $1.65 billion.

Over the previous 12 months, Qualcomm shares are off 2.1%, in contrast with a ten.3% decline for the PHLX Semiconductor Index

SOX,

-0.49%,

a 12% decline by the S&P 500 index

SPX,

+0.21%

and an 11.4% drop by the tech-heavy Nasdaq Composite Index

COMP,

-0.01%.