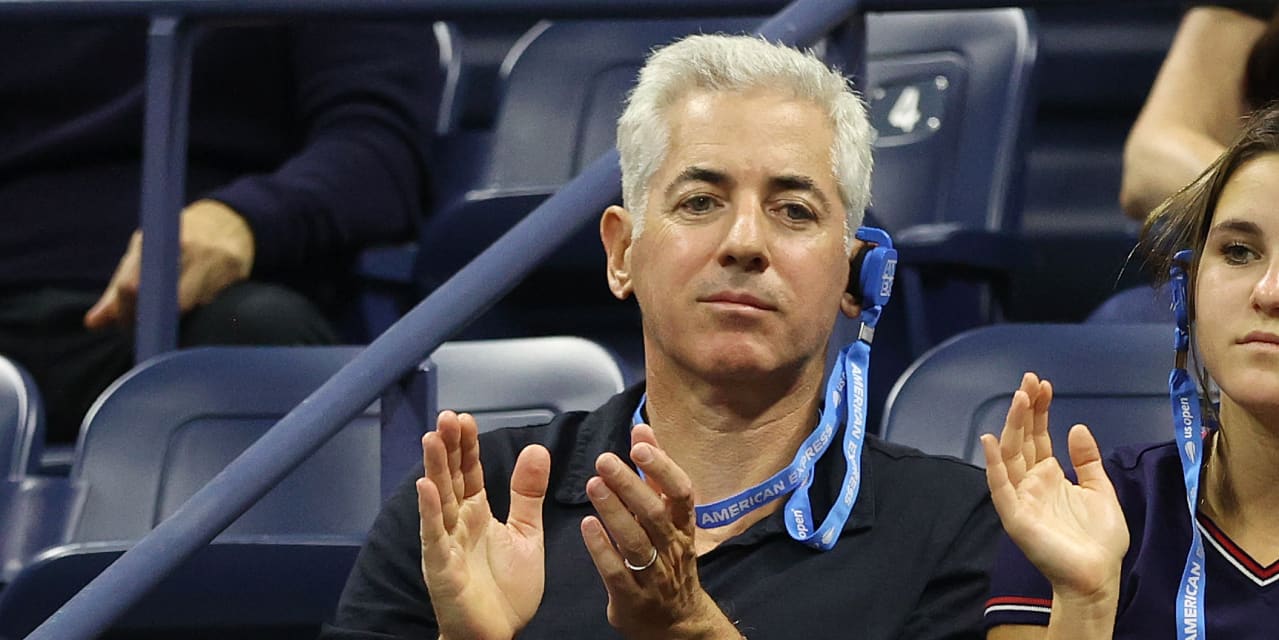

Hedge-fund titan Bill Ackman seems to be strolling again feedback he made through Twitter final week about Sam Bankman-Fried that some interpreted as implicit help for the 30-something who presided over one of the epic bankruptcies in monetary markets in latest reminiscence.

Last week, Ackman tweeted that Bankman-Fried’s statements made throughout a broadly watched interview, streamed to New York from the crypto founder’s location within the Bahamas, was “believable.”

“Many have interpreted my tweet to mean that I am defending SBF or somehow supporting him. Nothing could be further from the truth,” Ackman wrote Saturday, referring to Bankman-Fried by his initials SBF.

Ackman went on to explain the implosion of Bankman-Fried’s crypto change FTX, and a few of its related companies, as “at a minimum, the most egregious, large-scale case of business gross negligence that I have observed in my career.”

Check out: The Sam Bankman-Fried roadshow rolls on: 10 loopy issues the FTX founder has simply stated

Ackman, who’s the chief govt of Pershing Square Capital, a outstanding investor in conventional markets, and an advocate of crypto, final week, tweeted this message following the broadly watched interview of Bankman-Fried on the New York Times Dealbook Summit:

“Call me crazy, but I think SBF is telling the truth.”

Ackman has been chastised by some for seemingly providing verbal succor to an individual who some have accused of, at least, an epic mismanagement of consumer property.

Speaking towards the desires of his legal professionals, Bankman-Fried on Wednesday, through the Dealbook interview, admitted to creating errors however stated that he by no means meant to mingle consumer funds with these of the agency to make leveraged bets on crypto through hedge fund Alameda Research, which he based earlier than he began FTX.

“I didn’t know exactly what was going on,” Bankman stated on the time.

At least one response to Ackman’s Saturday tweet, questioned whether or not the hedge funder is likely to be responding to blowback from his personal shoppers.

It isn’t the primary time that Ackman has solid Bankman-Fried’s actions in a constructive gentle. As the implosion of FTX was unfolding, Ackman stated, in a now-deleted tweet, that he’d by no means earlier than seen a CEO take accountability because the crypto change operator did and that he wished to offer him “credit” for his actions. “It reflects well on him and the possibility of a more favorable outcome” for FTX, he wrote.

On Saturday, one Twitter consumer requested Ackman if had any ties to Bankman-Fried, which the investor bluntly stated he doesn’t.

Bankman-Fried had been considered as a monetary darling inside and outdoors the crypto business till his empire collapsed on Nov. 11 and it was revealed that affiliated hedge fund Alameda misplaced billions in FTX consumer cash in leveraged crypto bets.

John Ray, the brand new chief govt of FTX, in a submitting to the U.S. Bankruptcy Court for the District of Delaware, described the state of the crypto platform “as a complete failure of corporate controls and such a complete absence of trustworthy financial information.”