This previous month has seen the bears come out, because the market has entered a correction. The NASDAQ is down 13% because the begin of 2022, a loss that has truly erased its 12-month acquire. The S&P 500 hasn’t dipped fairly that far but, however remains to be down 8% year-to-date. The drop has had traders questioning whether or not or not the earlier 12 months’s sustained bull run has ended.

Looking on the macro scenario from Oppenheimer, chief funding strategist John Stoltzfus would advise traders to not flip pessimistic fairly but. Stoltzfus believes that the approaching months are prone to convey us reduction from each the pandemic and the availability chain disaster. Looking forward, Stoltzfus says, “It would appear to us to be time for writing shopping lists of fundamentally sound stocks, sectors and thematic investment ideas that might ‘have gotten away from us’ in last year’s market upswings…”

The inventory analysts from Oppenheimer are following Stoltzfus’ lead, and selecting out the shares they see gaining as we march additional into 2022. They see the present correction as an opportunity to purchase at a reduction, in preparation for higher instances forward. Using TipRanks’ database, we have situated two of these Oppenheimer picks, which the agency expects to surge by 70% or higher.

Hertz Global (HTZ)

We’ll begin with one of many world’s most acknowledged manufacturers, Hertz. The automotive rental large operates the Hertz, Dollar, and Thrifty rental firms, and boasts a worldwide attain – greater than 10,000 areas in 145 international locations on 6 continents.

There was a weak spot, nevertheless, that the COVID pandemic uncovered. Hertz is determined by a buyer base that’s in transit – and the pandemic shut down journey, slamming the corporate and drastically lowering the worth of its chief asset, its intensive automotive fleet. At the identical time, Hertz’s collectors known as of their loans, which had been secured by these very automotive fleets. The mixture was an excessive amount of, and Hertz entered chapter proceedings in May of 2020. After greater than a 12 months of litigation and restructuring, the corporate emerged in July 2021 in a robust place, having discharged $5 billion in debt and secured $5.9 billion in new capital.

Story continues

A take a look at the final quarterly report, for 3Q21, reveals the extent of the corporate’s turned fortunes. The high line income, of $2.2 billion, was up 19% year-over-year, whereas adjusted diluted EPS, at $1.20, was enormously improved from the 3Q20 EPS lack of 44 cents. The firm had $2.7 billion in unrestricted money as of September 30, 2021. The firm will report its This autumn outcomes towards the tip of February.

In addition to sound financials, Hertz has additionally been transferring to align its enterprise with trendy tendencies. The firm is partnering with the used car e-commerce firm Carvana to streamline its used automotive disposition channels. The partnership will see Hertz promote used fleet autos by Carvana, to profit each firms. Also, Hertz is working with Uber and Tesla on a mission to affect its rental fleet, and will probably be making as much as 50,000 Tesla autos out there to prospects who hire by Uber’s community.

And final, Hertz has made a transfer that ought to please traders. The firm introduced in November that it has accredited a share repurchase program of as much as $2 billion.

In brief, Hertz has emerged from chapter with stable plan to maneuver ahead, and the flexibility to execute on it. Nevertheless, the inventory is down 48% from the height it reached in November of final 12 months.

However, Oppenheimer’s Ian Zaffino sees Hertz in stable place, and poised for takeoff.

“With a meaningfully improved cost structure, an under-levered balance sheet and newfound competitive discipline, we believe Hertz is an interesting post-bankruptcy equity. The company has the potential to roughly double its pre-COVID EBITDA margins, even as auto production and the operating environment normalize.”

He went on so as to add that “Hertz has been highly forward-looking, as it positions itself for the future of the rental industry. It recently announced agreements with Tesla, Carvana, and Uber. The Tesla deal has the potential to be margin accretive, especially if EVs prove to have better economics. Further, the Carvana partnership expands Hertz’s disposition channel and could add $50M+ to EBITDA.”

To this finish, Zaffino places an Outperform (i.e. Buy) score on the inventory, not shocking in gentle of his feedback, and his $31 value goal implies an upside of 72% for the 12 months forward. (To watch Zaffino’s monitor report, click on right here.)

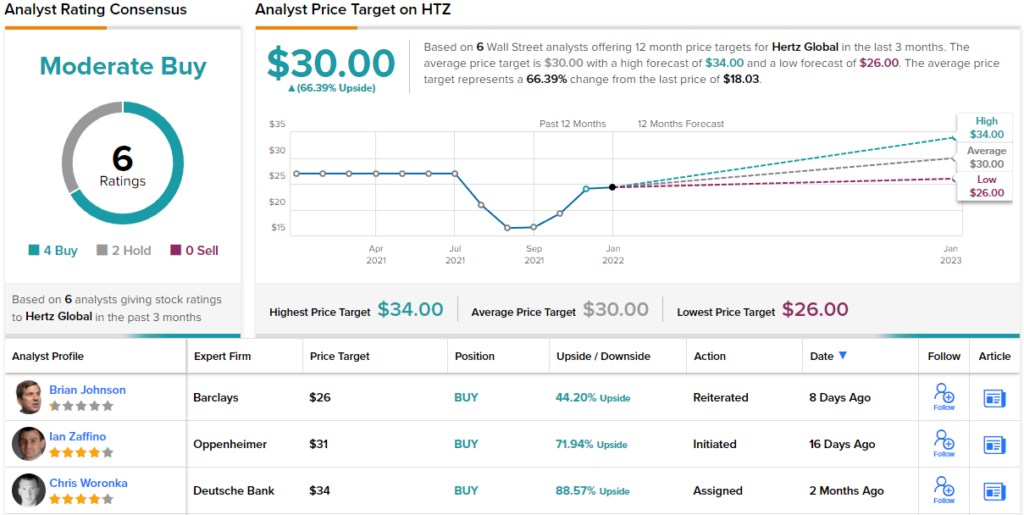

Overall, Hertz shares get a Moderate Buy score from the analyst consensus on Wall Street. The inventory has 6 current analyst evaluations, breaking all the way down to 4 Buys and a couple of Holds. The common value goal of $30 implies a one-year upside of ~66% from the present share value of $18.01. (See Hertz inventory forecast on TipRanks)

Vacasa (VCSA)

The second Oppenheimer decide we’ll take a look at is Vacasa, one other firm that has benefited tremendously from the reopening of the financial system and the gradual scaling again of COVID restrictions. Vacasa, based mostly in Portland, Oregon, is a trip administration firm, connecting vacationers with locations to remain. The firm operates in 34 US states, plus the international locations of Canada, Mexico, Belize, and Costa Rica. It’s properties, totaling greater than 35,000, have picked up practically 300,000 5-star evaluations, and Vacasa boasts that it facilitates trip stays for greater than 3 million visitors yearly.

This firm went public simply this previous December, by a SPAC transaction with TPG Pace Solutions Corporation. The deal noticed the VCSA ticker begin buying and selling on December 7, and introduced the corporate over $340 million in new capital.

From one perspective, this firm went public at simply the correct time. Customer conduct tendencies have shifted favorably in current months, as individuals are discovering that they’ll journey and have the funds to take action. The firm launched its 3Q21 outcomes a couple of weeks earlier than finishing the SPAC transaction, and confirmed report income of $330 million. That was a 77% acquire year-over-year, and beat the corporate’s quarterly income goal by 28%. The firm offered over 1.8 million trip nights in Q3, properly above the 1.1 million offered within the year-ago quarter. Looking ahead, Vacasa raised its full-year 2021 income steerage by greater than $100 million, to the vary of $872 million to $877 million.

A take a look at the corporate’s inventory value chart could seem worrisome at first look. The inventory is down ~40% since going public. However, Oppenheimer analyst Jed Kelly doesn’t see cause to fret, and actually, believes that Vacasa is within the technique of turning into the chief in its market.

“VCSA is leveraging its positioning as the largest vacation rental management platform in the US to increase its scale advantages and acquire outsized inventory share as consumer preference for the segment grows. We see this dynamic facilitating VCSA’s evolution into a national hospitality brand and generating upward revisions to LT estimates. Additionally, we expect a robust demand environment continuing in ’22,” Kelly famous.

“We see extra liquidity (6/5/22 lockup), and powerful execution enabling VCSA to shut the valuation hole with its on-line journey friends,” the analyst summed up.

Kelly thinks the inventory has some method to go, and by a way, we imply 96% of upside. Those are the returns traders are taking a look at, ought to the inventory make all of it the way in which to Kelly’s $12 value goal. No want so as to add, the analyst’s score is a Buy. (To watch Kelly’s monitor report, click on right here)

All in all, Vacasa at present holds a Moderate Buy score from Wall Street’s analysts; in its brief time as a public firm, it has picked up 4 Buy evaluations in opposition to 2 Holds. The inventory is promoting for $6.10 and has a bullish 103% upside potential based mostly on the $12.40 common value goal. (See VCSA inventory forecast on TipRanks)

To discover good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Best Stocks to Buy, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is essential to do your personal evaluation earlier than making any funding.