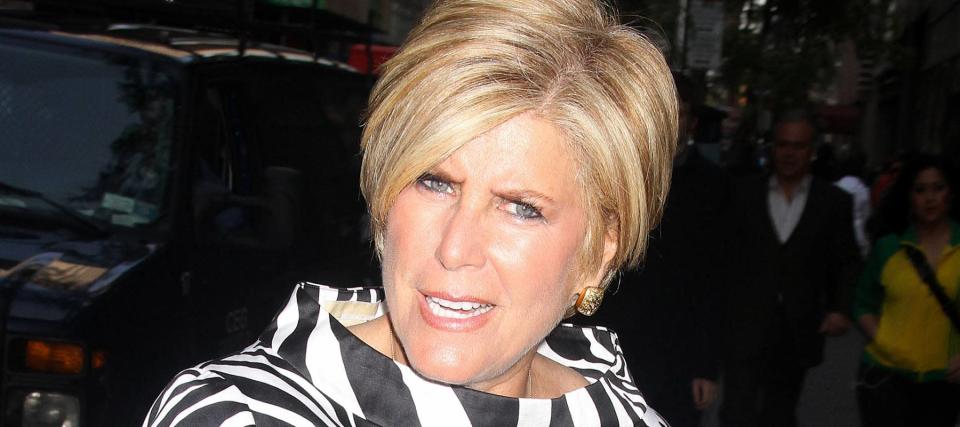

Suze Orman: Avoid making this ‘enormous mistake’ when refinancing your mortgage

With mortgage charges trending upward, owners have been scrambling to refinance earlier than charges go a lot greater. They’re now at ranges that might nonetheless be thought-about traditionally low, so a refi can slash your month-to-month cost — usually by lots of of {dollars}.

If you are pondering of making use of for a refinance mortgage, private finance creator and TV persona Suze Orman needs you to pause and take a deep breath — so you will not blow it.

“It makes me so loopy how most householders make an enormous mistake once they refinance,” she says.

It’s a blunder Orman says can simply saddle you with hefty curiosity prices, even in case you handle to land a mortgage fee your mates will envy.

‘So very unsuitable’

The common 30-year fastened mortgage fee sat beneath or shut to three% for months earlier than popping again over the road throughout the fall. This week’s typical fee is 3.05%, in line with mortgage large Freddie Mac.

But even with charges barely elevated, you may nonetheless save lots of per 30 days by refinancing. Almost half (47%) the owners who refinanced over the yr that led to April at the moment are saving no less than $300 month-to-month, a current Zillow survey discovered.

Orman is anxious that many enthusiastic refinancers make a pricey mistake: robotically reaching for an additional 30-year mortgage, even when they have been paying down their present 30-year mortgage for years.

“This is so very unsuitable,” the non-public finance guru writes in her weblog.

She says let’s suppose you have been paying down your unique mortgage for 14 years, you then take out a brand new 30-year mortgage. “Sure, the brand new mortgage is at a decrease rate of interest, however you simply prolonged your mortgage cost on this residence to 44 years!” she says.

When a 30-year refinance may make sense

Trong Nguyen / Shutterstock

The 30-year fixed-rate mortgage is America’s hottest residence mortgage, so it would naturally be the go-to for owners who need to commerce of their present mortgages for a greater deal.

And it is the apparent selection in case your mortgage is pretty new. Just two years in the past, 30-year mortgages have been averaging about 3.75%, Freddie Mac says.

Story continues

But, like many consultants, Orman typically recommends refinancing to a brand new mortgage with a shorter time period.

“My rule of refinancing is that you’re to by no means prolong your whole payback interval previous 30 years,” she says within the weblog.

Let’s say you might be certainly nonetheless holding on to a 30-year mortgage you took 14 years in the past, possibly throughout September 2007.

Back then, charges have been averaging a stiff 6.40%. (Seriously, it’s best to have refinanced prior to now.) Say your mortgage was initially within the quantity of $250,000; you’d now have a steadiness left of about $188,000.

Why to think about refinancing right into a shorter-term mortgage

If you have been to refinance that $188,000 steadiness to a brand new 30-year mortgage at immediately’s common fee of three.05%, and stick with the mortgage for your complete time period, the lifetime curiosity would high $99,000.

You might select to do a 15-year refinance as an alternative. Fifteen-year mortgages have decrease rates of interest than 30-year loans: The common for a 15-year is at present simply 2.30%, comparatively near the current all-time low of two.10%.

With a $188,000 15-year mortgage at 2.30%, you’d pay curiosity of about $34,500 over the lifetime of the mortgage. That’s $64,500 lower than the 30-year refinance.

But many refinancers do not go for a 15-year mortgage as a result of they do not suppose they will afford the upper funds:

The month-to-month cost (principal plus curiosity) on a 30-year refi within the quantity of $188,000 at 3.09% is $798.

The month-to-month cost (principal plus curiosity) on a 15-year refi within the quantity of $188,000 at 2.33% is $1,236.

But Orman says lately 15-year mortgage charges have been so low “that you simply might be able to refinance your remaining steadiness and find yourself with a cost that isn’t a lot totally different than what you have been paying in your 30-year.”

And in our instance, it is true:

The month-to-month cost (principal plus curiosity) on the unique 30-year mortgage within the quantity of $250,000 at 6.4% was $1,563. The new 15-year mortgage prices $327 much less per 30 days.

30-year refi or 15-year? How to decide on

Albert H. Teich / Shutterstock

Suze Orman says remember about closing prices when doing all your refinance math.

Whichever sort of mortgage you choose in your refinance, you need to really feel sure you are going to keep within the residence a couple of years.

“There isn’t any such factor as a free refinance,” Orman says. “You will both pay closing prices — which generally is a few proportion factors of your mortgage value — or the next rate of interest.”

Refi closing prices common about $3,400, in line with the newest knowledge from the analysis agency ClosingCorp. You will not need to transfer till after the financial savings from that new, decrease mortgage fee of yours have paid off the closing prices after which some.

If you consider you are in the home for the lengthy haul, refinancing right into a 15-year mortgage will be the clever selection — in case you can deal with the stiffer funds. Your rate of interest will likely be decrease and you will pay tens of 1000’s much less in curiosity over time.

Going with one other 30-year mortgage and its decrease month-to-month prices will be the smarter transfer in case you’re not prone to keep in the home long run. If it’s possible you’ll be leaving inside a couple of years, what does it matter if in case you have a 30- or a 15-year mortgage?

Before you choose any mortgage, store round. Don’t assume the very first lender you hit up will give you the bottom fee potential.

Gather mortgage gives from a number of lenders to seek out the perfect fee out there in your space and for an individual together with your credit score rating. If you are undecided about your rating, it is easy immediately to examine your credit score rating free of charge.

Then, put your comparability purchasing expertise to the check once more while you get your renewal discover in your owners insurance coverage. You can simply get a number of residence insurance coverage quotes and examine charges, to search for a greater value in your coverage.

This article offers info solely and shouldn’t be construed as recommendation. It is offered with out guarantee of any form.