Could it’s that Big Oil’s subsequent huge factor bought a giant help from Joe Biden?

Maybe, if carbon seize and storage is certainly as huge a deal as ExxonMobil’s first-of-its-kind deal to extract, transport and retailer carbon from different corporations’ factories implies.

The deal, introduced final month, requires ExxonMobil to seize carbon emitted by CF Industries’ ammonia manufacturing unit in Donaldsonville, La., and transport it to underground storage utilizing pipelines owned by Enlink Midstream. Set to start out up in 2025, the deal is supposed to herald a brand new stage in coping with carbon produced by producers, and is the most recent step in ExxonMobil’s often-tense dialogue with traders who need oil corporations to slash emissions.

The Inflation Reduction Act, handed in August, might decide whether or not offers like Exxon’s grow to be a development. The regulation expands tax credit for capturing carbon from industrial makes use of in a bid to offset the excessive up-front prices of plans to seize carbon from locations like CF’s plant, as different tax credit within the regulation decrease prices of renewable energy and electrical vehicles.

The Inflation Reduction Act and Big Oil

The regulation might assist oil corporations like ExxonMobil construct worthwhile companies to exchange a number of the income and revenue they’re going to lose as EVs proliferate. Though the corporate is not sharing monetary projections, it has dedicated to investing $15 billion in CCS by 2027 and ExxonMobil Low-Carbon Solutions president Dan Ammann says it might make investments extra.

“We see a giant enterprise alternative right here,” Ammann informed CNBC’s David Faber. “We’re seeing curiosity from corporations throughout an entire vary of industries, an entire vary of sectors, an entire vary of geographies.”

The deal requires ExxonMobil to seize and take away 2 million metric tons of carbon dioxide yearly from CF’s manufacturing unit, equal to changing 700,000 gasoline-powered automobiles with electrical variations.

Each firm concerned is pursuing its personal model of the low-carbon industrial economic system. CF needs to provide extra carbon-free blue ammonia, a course of that always includes extracting ammonia’s elements from carbon-laden fossil fuels. Enlink hopes to grow to be a type of railroad for captured CO2 emissions, calling itself the would-be “CO2 transportation supplier of selection” for an industrial hall laden with refineries and chemical vegetation.

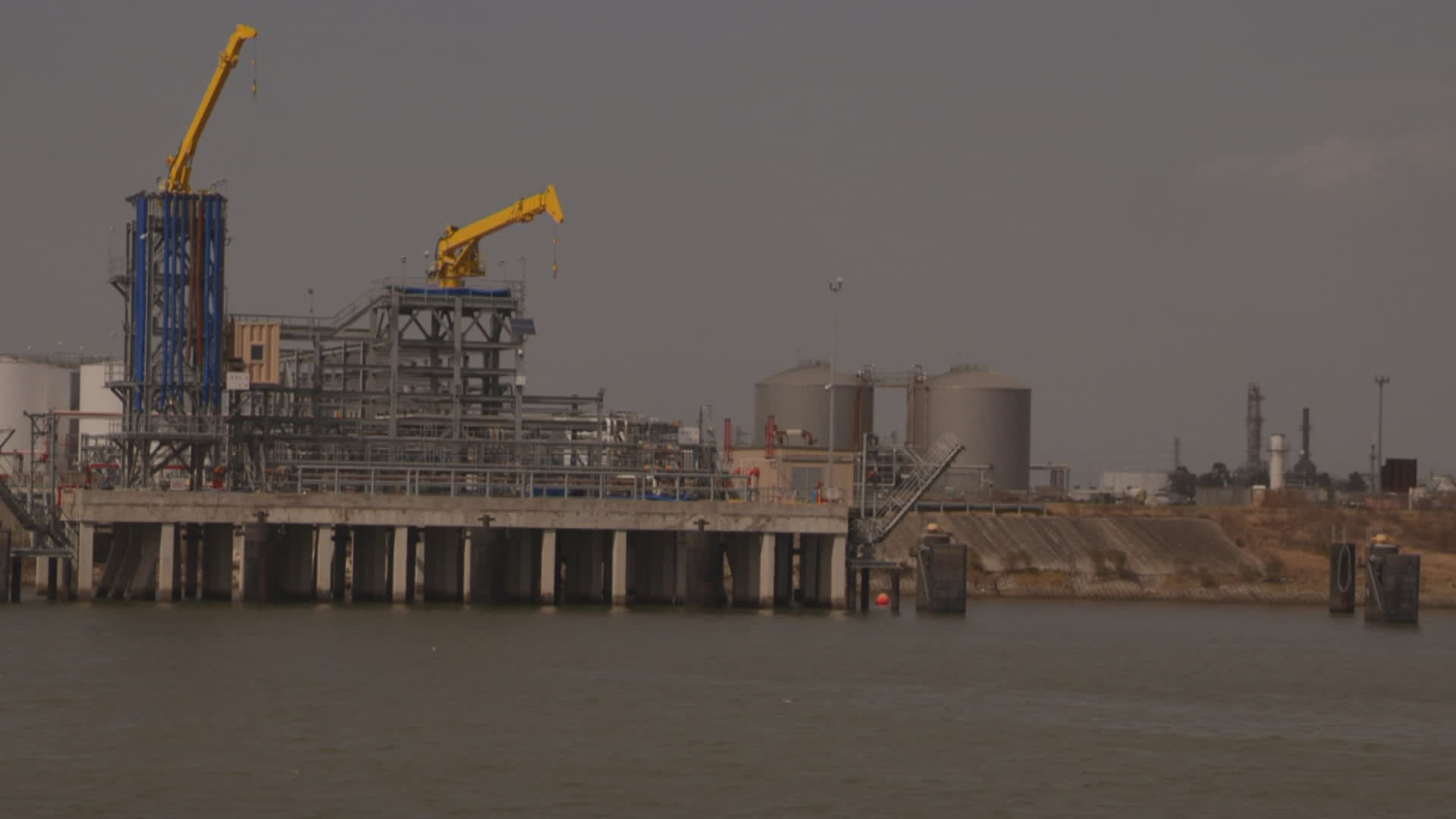

An industrial facility on the Houston Ship Channel the place Exxon Mobil is proposing a carbon seize and sequestration community. Between this industry-wide plan and its first deal for one more firm’s CCS wants, ExxonMobil is hoping that its low-carbon enterprise rapidly scales to a official income and revenue.

CNBC

Exxon itself needs to develop carbon seize as a brand new enterprise, Amman mentioned, pointing to a “very huge backlog of comparable initiatives,” a part of the corporate’s pledge to take away as a lot carbon from the environment as Exxon itself emits by 2050.

“We need oil corporations to be lively members in carbon discount,” mentioned Julio Friedmann, a deputy assistant vitality secretary below President Obama and chief scientist at Carbon Direct in New York. “It’s my expectation that this may grow to be a flagship mission.”

The key to the sudden flurry of exercise is the Inflation Reduction Act.

“It’s a very good instance of the intersection of fine coverage coming along with enterprise and the innovation that may occur on the enterprise aspect to deal with the large drawback of emissions and the large drawback of local weather change,” Ammann mentioned. “The curiosity we’re seeing, the backlog, are all confirming that is beginning to transfer and beginning to transfer rapidly.”

The regulation elevated an present tax credit score for carbon seize to $85 a ton from $45, Goldman mentioned, which is able to save the Exxon/CF/Enlink mission as a lot as $80 million a 12 months. Credits for captured carbon used underground to reinforce manufacturing of extra fossil fuels are decrease, at $60 per ton.

“Carbon seize is a giant boys’ sport,” mentioned Peter McNally, international sector lead for industrial, supplies and vitality analysis at consulting agency Third Bridge. “These are billion-dollar initiatives. It’s huge corporations capturing giant quantities of carbon. And huge oil and gasoline corporations are the place the experience is.”

Goldman Sachs, and environmentalists, are skeptical

A Goldman Sachs group led by analyst Brian Singer referred to as the regulation “transformative” for local weather discount applied sciences together with battery storage and clear hydrogen. But its evaluation is much less bullish in relation to the influence on carbon seize initiatives like Exxon’s, with Singer anticipating extra modest positive aspects because the regulation accelerates improvement in longer-term initiatives. To velocity up funding extra, corporations should construct CCS programs at higher scale and invent extra environment friendly carbon-extraction chemistry, the Goldman group mentioned.

Industrial makes use of are the third-largest supply of greenhouse gasoline emissions within the U.S., in line with the EPA. That’s narrowly behind each electrical energy manufacturing and transportation. Emissions discount in industrial makes use of is taken into account dearer and tough than in both energy technology or automobile and truck transport. Industry is the main target for CCS as a result of utilities and automobile makers are wanting first to different applied sciences to chop emissions.

Almost 20 p.c of U.S. electrical energy final 12 months got here from renewable sources that change coal and pure gasoline and one other 19 p.c got here from carbon-free nuclear energy, in line with authorities information. Renewables’ share is rising quickly in 2022, in line with interim Energy Department stories, and the IRA additionally expands tax credit for wind and solar energy. Most airways plan to scale back their carbon footprint by switching to biofuels over the subsequent decade.

More oil and chemical corporations appear prone to get on the carbon seize bandwagon first. In May, British oil large BP and petrochemical maker Linde introduced a plan to seize 15 million tons of carbon yearly at Linde’s vegetation in Greater Houston. Linde needs to develop its gross sales of low-carbon hydrogen, which is often made by mixing pure gasoline with steam and a chemical catalyst. In March, Oxy introduced a take care of a unit of timber producer Weyerhauser. Oxy received the rights to retailer carbon beneath 30,000 acres of Weyerhauser’s forest land, even because it continues to develop bushes on the floor, with each corporations ready to develop to different websites over time.

Still, environmentalists stay skeptical of CCS.

Tax credit might reduce the price of CCS to corporations, however taxpayers nonetheless foot the invoice for what stays a “boondoggle,” mentioned Carroll Muffett, CEO of the Center for International Environmental Law in Washington. The largest a part of industrial emissions comes from the electrical energy that factories use, and manufacturing unit house owners ought to scale back that a part of their carbon footprint with renewable energy as a prime precedence, he mentioned.

“It makes no financial sense on the highest ranges, and the IRA would not change that,” Muffett mentioned. “It simply modifications who takes the chance.”

Friedman countered by saying economies of scale and technical improvements will trim prices, and that CCS can scale back carbon emissions by as a lot as 10 p.c over time.

“It’s a relatively sturdy quantity,” Friedmann mentioned. “And it is about issues you possibly can’t simply handle another method.”