There are hundreds of publicly traded firms on the market, and so they all ship out a spread of indicators that traders should be taught to interpret. Parsing these indicators is important for investing success, and having a transparent technique, based mostly on dependable market indicators, usually makes the distinction between gaining or dropping available in the market.

One of the clearest indicators that retail traders can observe is the shopping for patterns of company insiders. These are the corporate officers who maintain excessive positions – CEOs, CFOs, COOs, Board members – giving them each entry to their firms’ interior workings and duty to Boards and shareholders for bringing in earnings. The outcome: insiders don’t purchase their very own inventory calmly, and after they do, traders ought to take be aware.

To get our personal really feel for this technique, we’ve used the TipRanks Insiders’ Hot Stocks instrument to tug up particulars on two equities whose insiders have been shopping for just lately. There are different constructive signifiers to observe; these shares are rated as Strong Buys by the analyst consensus and are projected to select up steam within the months forward. Let’s take a better look.

Petco Health and Wellness (WOOF)

We’ll begin with a have a look at an organization that’s each outdated and new within the public markets. Petco, the well-known pet provide chain and model, sells every little thing from pet meals and primary care provides to pet homeowners’ insurance coverage to grooming, and shops even carry a choice of small dwell animals. The firm went public final January for the third time in its historical past. Last yr’s IPO noticed the corporate put 48 million shares available on the market, at $18 every, and lift greater than $864 million in gross proceeds.

Petco received’t report its This autumn or full-year 2021 numbers till March, however we will get a really feel for the corporate with a have a look at the Q3 numbers launched in November. The firm reported $1.44 billion on the prime line, comparatively flat sequentially however up 15% year-over-year and practically 5% above estimates. Net revenue got here in at 20 cents per share, and the corporate raised its 2021 full yr steering.

Story continues

Nevertheless, the inventory fell sharply after the earnings launch as a consequence of a major gross margin shortfall. Specifically, gross margins declined 180 bps year-over-year, falling wanting consensus -130 bps estimate. The firm attributed the stress primarily to the next mixture of consumables gross sales as a consequence of evaluating towards a interval final yr with an unusually low combine and as a consequence of efficiently retaining and rising its consumables enterprise.

What it means is, WOOF shares at the moment are priced low, and at the very least two insiders took be aware. Michael Nuzzo, who wears a number of hats as EVP, CFO, and COO, spent over $78,000 on 4,340 shares. More importantly, maybe, firm CEO and Chairman Ron Coughlin purchased 23,290 shares, placing down over $400,000 for the inventory.

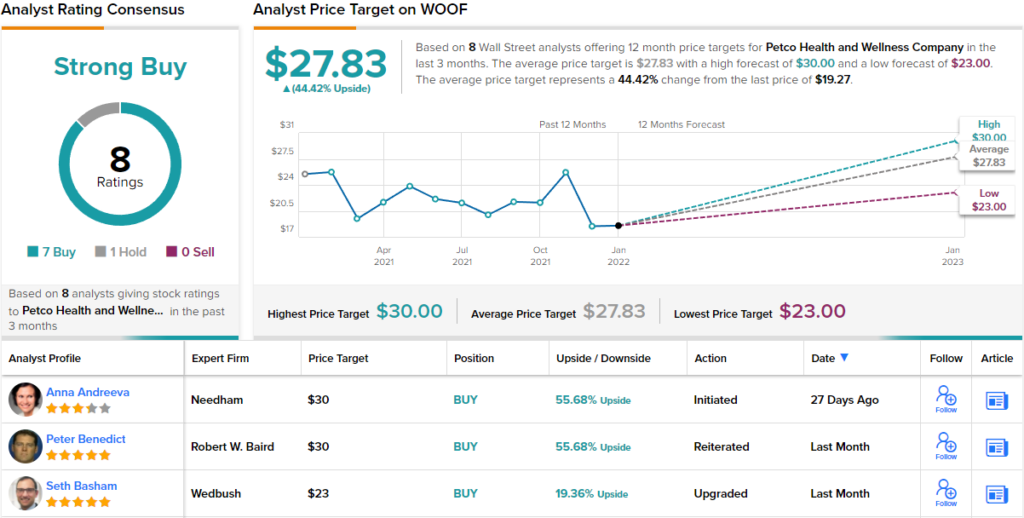

On the analyst entrance, Needham analyst Anna Andreeva sees this inventory as undervalued, and priced at a beautiful level of entry, with constructive long-term outlook.

“[The] inventory has pulled again publish 3Q21 print and is now buying and selling at 1x EV/Sales on ’22–we suppose a premium is warranted given less-discretionary nature of the pet class, a number of initiatives to drive natural prime line development forward of the pet area, and EBITDA growth (up to now 3 years, EBITDA margins are up solely 20-30 bps, on sturdy prime line leverage, with greater opex management alternatives nonetheless forward),” Andreeva famous.

“With its omni-channel footprint, WOOF needs to be rising sooner than the pet class (projected at HSD by 2025) given early innings of vet hospital growth (172, alternative for 900+), conversion of shoppers to multi-channel (aided by a novel relationship with DoorDash for similar day supply) and development of recurring/high-loyalty income streams like repeat, BOPUS, Vital Care and PupBox,” the analyst added.

To this finish, Andreeva charges WOOF a Buy, and her $30 value goal implies a one-year upside of ~56%. (To watch Andreeva’s observe document, click on right here)

Overall, it’s clear that Wall Street agrees with this upbeat tackle Petco. The firm’s inventory has 8 current evaluations, which embody 7 to Buy and only one to Hold and assist the Strong Buy analyst consensus. Shares are buying and selling for $19.27 and their $27.83 common value goal signifies room for a 44% upside within the subsequent 12 months. (See WOOF inventory forecast on TipRanks)

Adobe, Inc. (ADBE)

From retail pet provides we’ll transfer on to the tech business, the place a lot of the current market motion has been happening. Adobe, like Petco, is a widely known identify with a stable model and a robust product line. In addition to creating the PDF within the early Nineteen Nineties, Adobe can also be the purveyor of Photoshop, InDesign, and Illustrator, to call just some of its host of merchandise. The firm has switched its choices to the SaaS mannequin in recent times, and clients can entry the applications on the Adobe Creative Cloud.

This sturdy tech firm has an extended historical past of delivering outcomes, each for purchasers and traders. But this previous December, Adobe’s shares fell sharply, proper after the This autumn and full yr fiscal 2021 outcomes had been launched.

The fall in share worth got here despite the fact that the corporate primarily delivered, as soon as once more, on the highest and backside strains. Both income and EPS met expectation, coming in at $4.11 billion and $3.20 respectively. Revenue was up 19% year-over-year, and EPS up 13%.

Looking ahead, nevertheless, Adobe dissatisfied with its fiscal 2022 steering. The firm expects a prime line within the subsequent fiscal yr of $17.9 billion, lacking the expectation of $18.19 billion. And whereas administration predicts that annualized EPS will develop from $12.48 to $13.70 subsequent yr, Wall Street had been hoping to see $14.26.

The drop in share value has not discouraged Laura Desmond, from the corporate’s Board of Directors, from growing her holding. Last week, Desmond has bought over $1 million value of shares, in two tranches, one among 482 shares and the opposite of 492.

And she will not be the one assured in Adobe’s future. Deutsche Bank analyst Brad Zelnick, who holds a 5-star score from TipRanks, additionally believes that Adobe will proceed to ship development.

“We view Adobe as a number one enabler of digital experiences and see sturdy development forward regardless of its already-significant market share inside its core Creative market… The firm’s DX technique has blossomed since buying Omniture in 2009 with the synergies between DM and DX extra logical than ever. We are satisfied by the enormity of Adobe’s artistic TAM (which has been ever-expanding past expectations), its many levers for sturdy development, in addition to the even larger alternative in Digital Experience,” Zelnick opined.

Zelnick provides ADBE shares a Buy score, whereas his $715 value goal suggests the inventory has an upside of ~35% forward of it this yr. (To watch Zelnick’s observe document, click on right here)

Big-name tech corporations are inclined to get a number of consideration from Wall Street’s inventory analysts, and Adobe isn’t any exception. The inventory has no fewer than 24 analyst evaluations on document, and so they break down 18 to six (or 3 to 1, for those who choose) in favor of the Buys over Holds, for a Strong Buy analyst consensus view. ADBE is presently priced at $529.89 and its $674.67 common value goal signifies room for ~27% share appreciation from that stage. (See ADBE inventory forecast on TipRanks)

To discover good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Best Stocks to Buy, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is essential to do your personal evaluation earlier than making any funding.