What do you consider curler coasters? We could also be in for one in 2022, with the markets displaying increased volatility – and maybe a decrease internet acquire – than final 12 months. Headwinds embody rising inflation, the Fed’s probably actions to tighten financial coverage in response, and elevated labor prices. Tailwinds might embody that very same Fed motion, because it carries potential to blunt a ‘stagflationary’ interval, and a possible political shift ready within the fall.

Writing from Wells Fargo, senior fairness strategist Christopher Harvey is anticipating that the market will expertise a correction, that’s, a drop of 10%, by mid-year: “Pullbacks will likely be more frequent in this choppier equity market. Ultimately, the bend-but-not-break market mentality finally fails investors in 2022 in our view.”

Harvey’s view consists of a number of causative elements, which he lists clearly, writing, “Labor costs accelerate as retirements accelerate and white-collar workers capitalize on the relatively low friction associated with working from home for another employer… Earnings continue to move higher, but multiples do not. A combination of decelerating growth, hawkish Fed, peak pricing, and a belief that longer term US growth has not improved drives multiple compression and frustrates bulls.”

At the identical time, Harvey factors out that the mid-term elections – which often favor the occasion out of energy – are setting as much as be a smash-up for the Democrats and writes, “The GOP will gain control of Congress, adding perhaps two Senate seats and 25-30 House seats… This sets up a late-year rally as SPX history has favored Republican Senate control…”

For traders, the prospect of an unsure and unstable market local weather provides a transparent impetus towards defensive positions, and that may naturally get them trying to dividend shares. These are the basic performs to guard the portfolio from market pullbacks and volatility, and for good motive. A dependable dividend offers a gradual revenue stream regardless of the place the market goes.

Story continues

Using TipRanks’ database, we’ve pulled up the information on two dividend shares which have gotten the thumbs-up from Harvey’s colleagues at Wells Fargo. These are high-yield payers – within the vary of seven% or higher – excessive sufficient to remain engaging even when the Fed begins elevating charges. Here are the small print.

Black Stone Minerals (BSM)

We’ll begin with Black Stone Minerals, a hydrocarbon exploration and improvement firm – which is basically only a fancy approach to say Black Stone buys land holdings in areas wealthy in oil and pure fuel, and earnings from the exploitation of these sources. The firm’s land holdings embody over 20 million acres throughout 60 manufacturing basins in 40 states, giving Black Stone a versatile portfolio of energetic property.

The worth of the holdings will be seen from the steadily rising prime line. Black Stone has seen 5 consecutive quarters of sequential income good points, with the current 3Q21 outcome, over $137 million, the best previously two years.

In manufacturing phrases, Black Stone reported 33 million barrels of oil equal per day (MBoe/d) in Q3 royalty quantity, up from 31.1 million within the year-ago quarter. Total manufacturing was reported at 38 MBoe/d.

The firm’s strong manufacturing and royalty basis provides it confidence to take care of its dividend fee. The most up-to-date declaration, at 25 cents per frequent share, annualizes to $1 per share and provides a yield of seven.4%. This compares favorably to common div yield on the broader markets, which stands between 1.5% and a couple of%. Critically vital, the dividend fee was increased than had been anticipated; it was composed of an everyday dividend and a particular distribution. The dividend was paid out in November, with the following fee probably in February.

Well Fargo analyst Joseph McKay takes a bullish stand right here, primarily based partly on the corporate’s sound efficiency, upbeat outlook, and excessive dividend.

“We think BSM’s 3Q21 update and positive forward revisions (the result of a conservative approach from management coupled with robust commodity prices) should offer the sort of tangible positives that have been building over the past few quarters,” McKay noted.

“With our and consensus expectations already ~1 mboe/d above the implied target and robust natural gas prices and an acceleration of development activity in the Haynesville setting up an attractive risk/reward for volumes moving forward, we see forward results biased to the upside… With the balance sheet in solid shape, in our view and an ~18% improvement to net debt in October, we see increased potential for distribution growth moving forward,” the analyst added.

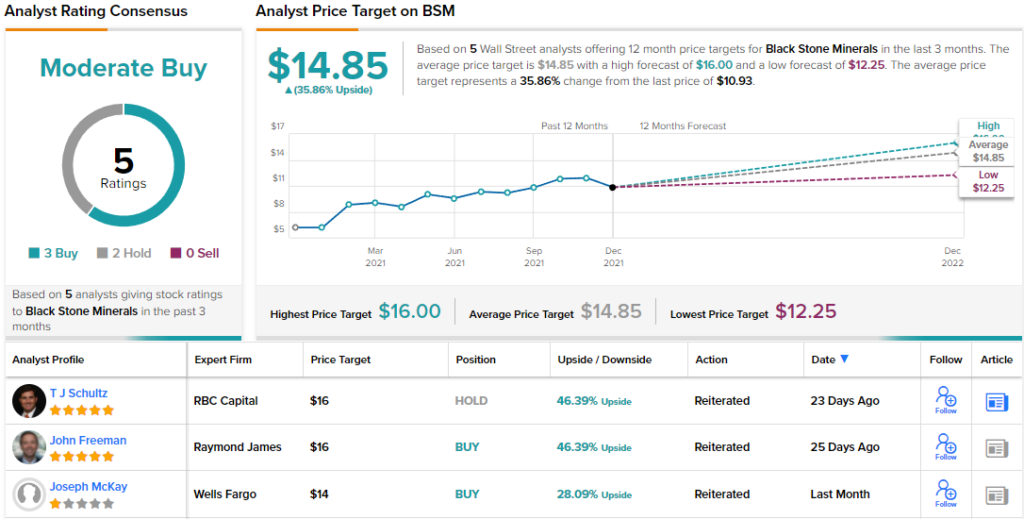

McKay’s bullish comments support his Overweight (i.e. Buy) rating here, and his $14 price target suggests an upside of ~30% for the year ahead. (To watch McKay’s track record, click here)

Overall, Wall Street is ready to buy this stock. BSM has 5 recent reviews, featuring a 3 to 2 breakdown of Buy over Hold to back a Moderate Buy consensus view. The average price target of $16 is somewhat higher than the Wells Fargo view, and implies a one-year upside of 37% from the current share price of $10.80. (See BSM stock analysis at TipRanks)

Oaktree Specialty Lending (OCSL)

The second stock we’ll look at is a finance provider, facilitating loans and credit in the mid-market enterprise segment. This customer base frequently has difficulty accessing tradition sources of capital and banking services; Oaktree’s important role is to fill that gap.

Oaktree currently has a $2.3 billion portfolio, invested in 135 client companies. Of the total, 68% of the portfolio is made up of first lien loans, and another 19% is second lien. The portfolio is broad and diversified, with a slight lean toward the tech sector – the two largest segments of the portfolio are in Application Software (14.3%) and Data Processing (7.1%).

In November, Oaktree reported its fiscal 4Q21 results, as well as full year results for fiscal 2021. For the quarter, the company showed $63.8 million in total investment income, down slightly from the previous quarter. The full year’s total investment income came to $209.4 million, up 46% year-over-year. Earnings were positive, at 16 cents per share for the quarter – although this was down 15% sequentially. Full-year earnings were up yoy, gaining 25% to reach 64 cents.

On the dividend, Oaktree declared a payment of 15.5 cents per common share. This was a 7% increase from the previous quarter, and better yet, was the sixth quarter in a row that the dividend was raised. At 62 cents per common share annualized, the payment yields a robust 8.2%.

Covering this stock for Wells Fargo, analyst Finian O’Shea wrote: “OCSL’s business has considerable momentum entering FY2022, in our view, as the BDC ended FY21 with net leverage of 0.94x, the highest since Oaktree took over the adviser contract, and ~24ppts above its average under Oaktree’s stewardship…. OCSL’s earnings profile was highly-sensitive to deployments, as incremental assets would be funded with its low-cost revolver, thus creating operating leverage from lower average funding costs.”

O’Shea provides Oaktree an Overweight (i.e. Buy) score together with an $8 worth goal indicating room for a modest 6.5% upside. Based on the present dividend yield and the anticipated worth appreciation, the inventory has ~15% potential complete return profile. (To watch O’Shea’s observe report, click on right here)

Judging by the consensus breakdown, opinions are something however blended. With 3 Buys and no Holds or Sells assigned within the final three months, the phrase on the Street is that OCSL is a Strong Buy. (See OCSL inventory evaluation on TipRanks)

To discover good concepts for dividend shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is essential to do your personal evaluation earlier than making any funding.